| |

| FORECAST (000 tons) |

| US |

1998 |

1999 |

2000e |

| Production |

7,302 |

7,432 |

7,842 |

| Capacity |

8,498 |

8,478 |

8,502 |

| Utilization rate (%) |

86 |

88 |

92 |

| Exports |

4,593 |

4,553 |

4,901 |

| Imports |

3,792 |

5,946 |

5,964 |

| U.S. consumption1 |

6,501 |

7,130 |

6,688 |

| Canada |

|

|

|

| Production |

8,166 |

8,870 |

– |

| Capacity |

9,572 |

9,372 |

9,543 |

| Utilization rate (%) |

85 |

95 |

– |

e=estimate 1. Shipments plus imports minus exports.

Sources: Pulp and Paper Products Council, American Forest & Paper Assn., |

| TOP N. AMERICAN PRODUCERS |

| |

Total North |

Market |

| |

America capacity |

share |

| Company |

(000 tons) |

(%) |

| Weyerhaeuser |

2,487 |

10.9 |

| Georgia-Pacific |

2,140 |

9.4 |

| International Paper |

1,745 |

7.7 |

| Parsons & Whittemore |

1,279 |

5.6 |

| Champion International |

1,111 |

4.9 |

| Bowater |

1,038 |

4.6 |

| Trmbec |

9153 |

4 |

| Fletcher Challenger Canada |

820 |

3.6 |

| Rayonier |

770 |

3.4 |

| Millar Western |

760 |

3.3 |

| Buckeye Techs. |

713 |

3.1 |

Market share of top five companies: 38%

Market share of top ten companies: 57%

Total North American capacity (1999): 22.749 million tons.

Note: Excludes pulp consumed internally or produced outside North America. Capacity includes equity ownership Source: Pulp & Paper Company Profiles. |

|

Market Pulp: strong upcycle lowers inventories, sends prices upward

Market Pulp: strong upcycle lowers inventories, sends prices upward

GRADE STRUCTURE. Of an estimated 160 million metric tons of total world woodpulp production, about 36 million mtons, or 23%, is traded “openly” in world markets outside integrated pulp and paper operations. Western Europe accounts for about 40% of world market pulp shipments, non-Japan Asia/Africa 20%; the U.S. 20%, and Japan 10%. Canada accounts for 9 million mtons, or about 28%, of world market pulp shipments.

The five dominant market pulp grades are mainly categorized by tree species, pulping process, and geography—either softwood or hardwood, kraft or mechanical, and northern or southern. The key products are northern bleached softwood kraft (NBSK), southern bleached softwood kraft (SBSK), northern bleached hardwood kraft (NBHK), southern bleached softwood kraft (SBSK), and bleached eucalyptus kraft (BEK).

NBSK, due to its high quality and brightness is used in a wide range of paper products and is considered the benchmark--usually the highest priced of commodity market pulp grades.

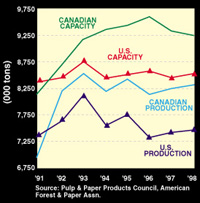

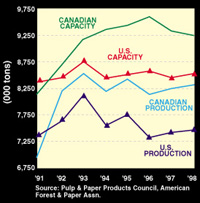

PRODUCTION/CAPACITY. World chemical paper-grade market pulp shipments in 1999 hit 33.9 million mtons, an 8.5% increase from 1998, according to preliminary data from the Pulp and Paper Products Council in Montreal. Global chemical market pulp production of 33.0 million mtons in 1999 was up 6.1% from a year earlier.

A key barometer of market conditions, North American/Scandinavian (Norscan) producer inventories at the end of May 2000 were at a very low 1.193 million tons, according to preliminary PPPC data, 15% lower than a year earlier. Norscan production year-to-date through May was 9.414 million mtons, up 4.2% from a year earlier, as the Norscan producers operated at an average of 98% of capacity compared with 96% a year earlier.

Key closures of pulp mills in the U.S. related to Cluster Rule pollution regulations led in 1999 to the first reduction of market pulp capacity in North America since the mid-1980s.

MARKET TRENDS. U.S. pulp markets in 1999-2000 have been marked by a series of quarterly price increases that have driven up average benchmark NBSK prices from about $495/mton in 1Q 1999 to about $680/mton in 2Q 2000. Price increases in 2000 were implemented Jan. 1 and Apr. 1, and the latest price increase was slated for July 1. Due to currency changes, prices in Europe were at record levels. U.S. market sources in May described very tight supply/demand conditions—although it was widely said that lagging paper prices threatened pulp demand in the second half of the year.

This year’s market is y compared with the mid-1990s, when NBSK prices soared to near $975/mton in 4Q 1995.

OUTLOOK. With low inventories at both producer and consumer levels, the series of price increases is expected to continue in the market pulp business into 2001. Concerns persisted over the health of market pulp customers—namely printing/writing paper mills in Europe and the U.S. who in 2000 were not able to quickly pass along price hikes for their own products. Pulp suppliers appeared cautious to not let pulp prices runup too fast or too high, and were generally following a quarterly pricing model to institute some stability in the market.

Industry debate in mid-2000 centered on the sustainability of the pulp upcycle. A July 1 price increase was expected to take NBSK prices in the U.S. from $680/mton toward $710/mton in the third quarter. Another increase for the fourth quarter appeared likely although sources appeared mixed whether more price hikes would seriously undermine papermakers and pulp demand.

By James McLaren

Executive Editor-Pulp & Paper Week

|