| |

|

|

|

Harold M. Cody is

Senior Editor,

Pulp & Paper

|

It's been said that technology changes so little in the pulp and paper industry that employees who worked in a paper mill 25 years ago could run one of today's paper machines. A project recently completed by St. Marys Paper in Sault Ste. Marie, Ont., clearly illustrates that, for some mills, new technology is not only a key to success, but required for survival. Three of the mill's supercalenders were recently rebuilt to incorporate modern load relieving lever arm technology, thereby becoming the first uncoated supercalendered (SC) groundwood mill to incorporate this system on an existing supercalender. The conversion has resulted in higher sheet gloss and better smoothness on the mill's SC grades. Total project cost was C$23 million, which represents considerable savings compared to installing a brand new multi-roll calender.

|

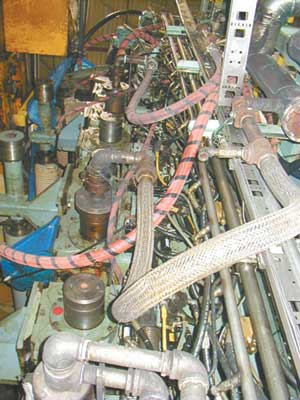

Before the rebuild, a maze of wires, piping, and instruments cluttered the frame and posed problems for mill maintenance staff.

|

The driving forces behind the supercalender upgrade project clearly illustrate the impact that technological advances are having on printing and writing paper markets. St. Marys Paper produces SC papers, primarily SC-A and SC-B grades, on three paper machines. The newer 184-in.-trim No. 5 paper machine was installed in the late 1980s, extensively upgraded in the 1990s, and mainly produces higher quality SC-A grades. Two other paper machines mainly produce SC-B grades.

Parent rolls from the three paper machines are finished by five supercalenders, with three stacks handling output of the No. 5 paper machine, while the No. 3 and No. 4 production lines each have one supercalender. All of the stacks are 10-roll units, and the No. 7 supercalender was installed in 1996. Thus, the finishing department had good equipment before the recent rebuilds, and the largest paper machine is modern and produces a good sheet.

|

The rebuilt stacks, showing the levers that provide the load-relief capability, are clean and simple to maintain and service.

|

TECHNOLOGY CHANGING SC PAPER MARKETS. The entire printing papers market, including the SC grades that are the focus of the Sault Ste. Marie mill, is undergoing change and is highly competitive. A major trend is a continuing move to higher and higher quality within all of the major SC paper segments, i.e., SC-A, SC-B, and SC-C. The project to rebuild the mill's supercalenders was in large part a reaction to these prevailing market trends, although capacity increases, both current and future, were also an important consideration. In fact, as part of an overall ongoing assessment of its competitive position, the company has investigated installing a new paper machine. This major expansion is only in the preliminary planning stages and any move forward is dependent on market conditions. The current rebuild project was chosen to address the need for higher quality, while also providing additional finishing capacity.

|

At St. Marys Paper, capital projects involve all levels, including operators, maintenance, and engineering. Part of the supercalender team included (Left to Right): Dan MacKay, Rolf Lindfors, Bob Allen, Dave Dube, Charles Sperry, Howard Gray, Iver Iverson, and Bill Verdi.

|

North American SC paper capacity has been growing rapidly, following several major conversions from grades such as newsprint and lower quality machine-finish groundwood papers. In addition, at the very top end of the SC market, brand new production lines—such as Stora's large new line in Port Hawkesbury, N.S.—continue to raise the quality bar. Mills that have upgraded from lower quality grades now operate new calendering equipment and many have rebuilt their paper machine's wet end to improve sheet formation. Therefore, sheet quality across the entire SC papers market, from top to bottom, has improved considerably as a result of new papermaking technology.

Producers of traditional SC-A grades, i.e., mills that use off-machine supercalendering, are competing with even higher quality SC-A plus grades. Similarly, the rapid growth in the production of soft-nip calendered papers, where all operations are moved on line, is also "pushing" quality up on the low end of the SC papers spectrum, in SC-B and SC-C grades. In addition, the move to online production can result in lower costs. The combination of lower costs and improved quality at mills with newer online equipment puts many traditional SC mills at a disadvantage.

A new wrinkle in the market is capacity coming on line from production lines incorporating extensive multi-roll calendering arrangements. For example, Great Northern Paper recently installed a 10-roll multi-nip online calender as part of a paper machine rebuild and conversion to SC production at the Millinocket, Maine, mill. Various market sources speculate that, due to the added number of nips that a 10-roll configuration provides, the mill may be able to produce a high quality SC-A sheet on line.

St. Marys Paper responded to these competitive pressures by upgrading its supercalenders in order to improve sheet quality. The mill considered various capital investment options, including rebuilding all five of the existing supercalenders. The mill chose to limit capital expenditures, and, thus, three of the five stacks were rebuilt during 2001.

A first step in the process was to conduct extensive trials to assess what the rebuild could accomplish. Paper was run at the Metso pilot plant in Finland, which confirmed that a rebuild would lead to increased sheet quality using the mills base sheet. The project team also visited a number of facilities to view the new calender technology first-hand, as well as to obtain input from operators, which has proven invaluable.

CONVERSION TO LOAD RELIEF TECHNOLOGY. The first supercalender, the No. 7 stack, was rebuilt in August 2001 to incorporate Metso's OptiLoad calendering technology. The rebuild took 11 days. The Nos. 5 and 6 stacks were rebuilt in sequence, one at a time, in September and October 2001. Due to the experience gained on the No. 7 stack, the others each only took 5 to 6 days. Engineering and construction management was handled by NLK. The mechanical work was performed by Superior Industrial Services, while electrical work was done by S&T Electrical, both of Sault Ste. Marie.

One major advantage of the one-at-a-time approach is that it minimized risk, since the other supercalenders remained in operation during the project. An additional "risk" in the project was that the Sym-Z crown controlled roll requires a higher level of maintenance than conventional swimming rolls. To counter this, additional funding was included for both mechanical and electrical and instrumentation training. The retrofit approach saved several million dollars compared to the cost to install brand new multi-roll stacks.

In order to accommodate the load relieving "levers" that comprise the OptiLoad system, the stacks are first stripped down to the frame. A steel wrap around framework is bolted onto the frame, and the lever arms are attached to this.

Following the rebuild, the supercalenders are configured with the Sym-Z roll as the No. 10, or top, roll. Following this are: No. 9, polymer roll; No. 8, chilled iron roll; No. 7, polymer roll; No. 6, polymer roll; No. 5, chilled iron roll; No. 4, polymer roll. A chilled iron drive roll is in the No. 3 position, followed by the No. 2 polymer roll, and the existing swimming roll is in the No. 1 position.

The new arrangement means that the stacks are loaded from the bottom, not down from the top as they were previously. The temperature control for the iron rolls was also revised so that the heating of the sheet's wire side could be controlled independently from the heating on the top side. The use of polymer rolls provides the capability to run at higher temperatures. Prior to the rebuild, the mill had mainly used cotton rolls with some polymer rolls in the stacks.

The Sym-Z roll has more control zones than a typical swimming roll, which provides better caliper control by providing eight adjustment zones rather than one. The chilled iron rolls are tri-pass rolls, meaning the heating medium makes three passes in the shell of the roll, whereas the old rolls were single pass. The new rolls also have better heat transfer and, with the aid of new, larger temperature control units, are able to operate at higher temperatures. The new chilled rolls have a 22-in. dia compared to the old 18-in.-dia rolls.

SHEET QUALITY IMPROVEMENTS. The rebuilt stacks started up quickly and sheet quality improved immediately. The streaks that occurred in the sheet prior to the rebuild have disappeared, and the Sym-Z roll produces a better sheet profile.

Prior to the rebuild, the sheet typically had a Parker Print Surf (PPS) smoothness of about 1.30, which improved to a PPS of 1.15. The mill hopes to reach an ultimate target of 1.00. Sheet gloss was 42 when running the old supercalenders but rose to 47 with the rebuilt stacks. The mill believes it is possible to reach the 58 to 60 range with further work. Due to the higher temperatures used in the OptiLoad, sheet moisture has been raised to 11%, with target moisture out of the stack of about 5.5%.

While the project was primarily market driven, it has produced several benefits, including a 20% increase in capacity per stack, reduced maintenance costs, and reduced downtime. All of these benefits were achieved without production downtime, a major issue for a mill running three paper machines and five supercalenders.

Despite the fact that the system is new technology, it has simplified the operation of the supercalenders. "It's more complex technology, but it's actually simpler to operate and maintain," notes Todd Black, St. Marys' engineering and maintenance manager. As an example, a roll change that could previously take hours now only takes about 15 minutes.

The cost to run the stacks should be lower than for the old supercalenders. The new units run faster, so they will actually run fewer hours for the same production, and maintenance costs will be less and cover costs are expected to be lower. The mill initially was hoping that roll cover life would be about 3,000 hours, but they are now looking at about a 2,000-hour interval between regrinds.

Another benefit of the rebuilt stacks is that they can handle paper with poorer profile. The sheet also has less two-sidedness than before. One change the mill is investigating is the addition of glycol to the rolls to improve heat transfer. The idea was the result of a visit to MeadWestvaco's Escanaba, Mich., mill, which converted to the OptiLoad system for its coated papers.

In order to get the sheet over the top of the supercalender when threading the tail from the parent roll, the mill developed an innovative handmade solution. Instead of installing an expensive threading system, they pass the sheet over the top of the stack using a clip attached to a pole.

Another unique aspect of the project to upgrade the mill's supercalenders involves the installation of Honeywell Calcoils on the No. 3 and No. 4 stacks. While this installation is very recent, it looks promising. The Calcoil units apply heat to the steel roll to provide caliper profiling capability. The use of this system on a supercalender is quite unique, the mill reports.

SC paper market expands, users switch substrates

|

|

The North American market for SC papers, which continues to expand, is characterized by fierce competition not only among different SC grades, but with lightweight coated (LWC) papers as well, particularly in magazine markets traditionally dominated by LWC. SC-A grades continue to benefit from users upgrading from lower quality sheets such as SC-B and SC-C, based on data for early 2002 provided by the SC Council. Through February, SC-A shipments to North American markets rose by 17.2% over prior year levels, and totaled 256,000 mtons. Shipments of other SC grades, which include SC-B and SC-C, were off about 7.5% at 178,500 mtons. North American SC-A shipments rose 17.0% to nearly 198,000 mtons, while shipments into North America by European producers rose 17.8% to 60,100 mtons.

The driving force behind this demand expansion is upgrading by large retail chains and commercial printers, reports Pulp & Paper Week (PPW). Part of the push to upgrade appears to be driven by a narrowing of the price gap between SC-A and lower quality grades. As of mid-March 2002, 35-lb SC-A prices were $30 to $35/ton higher than SC-B, PPW reports. The price differential in early 2001, by contrast, was $80 to $100/ton. The average transaction price on 35-lb SC-A in March was $700/ton on the low end of the range, compared to about $840/ton last year, according to market forecasting firm RISI. Overall weakness in the economy, and particularly in advertising, led to weak demand in 2001 and early 2002. As a result, prices have been trending down for SC and LWC grades (Figure 1).

|

Figure 1. Prices for SC-A papers and LWC have been trending down in recent months.

|

The overall SC papers market is expected to expand more rapidly than the modest growth in overall graphic paper demand in 2002, which is projected to grow only 0.6% this year, according to RISI. The main markets for SC grades are inserts and catalogs, but magazines are a key growth area for SC-A grades (Figure 2).

|

Figure 2. U.S. demand for SC papers is growing in markets such as magazines.

|

Technology is definitely having an impact on market strategies and market position. For example, at the top end of the market, SC-A plus grades that approach LWC in quality are putting tremendous quality and price pressure on other SC-A producers. For example, one tactic is to sell the SC-A plus grades at the same price as SC-A papers, thereby ensuring market share gains, since the buyer gets a better sheet for the price. In some cases, buyers are willing to pay a premium price for the better product. This varies but can be on the order of 10% to 12% above standard SC-A prices.

The quality issue is particularly critical in markets such as magazines. The magazine market is large, on the order of 3.5 million tons, mainly composed of LWC. However, some magazines now use SC-A grades, particularly in the smaller rotogravure segment more suited to SC papers. Magazines in total use an estimated 300,000 tons to 400,000 tons of SC-A annually. The larger segment is heat set offset, which is a very demanding market for SC papers, and where SC use is small. The total offset market is about 3.2 million tons of paper, most of it LWC. Only some SC producers, notably those with the newest equipment, can make an acceptable sheet with the high brightness and good surface required, but this sector represents enormous potential.

|

EMPLOYEE INVOLVEMENT PAYS DIVIDENDS. An essential and probably unique part of the capital investment process at St. Marys is the involvement of operators. This unusually broad level of involvement in capital purchase decisions has derived from the fact that the employees are part owners.

Belgravia Investments, whose holdings include coated paper mills in Texas and Oregon, as well as Alberta Newsprint, is the majority shareholder of the mill. The facility originally produced newsprint as part of Abitibi-Price, who sold it in the 1980s. Subsequent to its sale, the mill was switched to SC paper production, which included the addition of the No. 5 paper machine. Following the acquisition by Belgravia seven years ago, the mill's operation was restructured, with a key change being a move to employee ownership. The employees own approximately 30%.

Since its acquisition, about C$170 million has been invested in the facility, which represents a considerable portion of profits generated by the mill in the last seven years. Production has risen from the 495-stpd level when the mill was acquired to about 660 stpd for the last two years.

"Capex ideas typically come off the operating floor," notes Doug McBride, vice president of capital projects at St. Marys Paper. "The idea in turn goes to a committee staffed by volunteers from all areas of the operation, including maintenance and operations," he explains. "Area managers and staff engineering are added as needed, and the total group is typically about five to seven people. This team prepares a report that goes to the board of directors for review. The review is actually presented by the employees, not by senior mill management."

Team members that worked on the supercalender project included: Bob Allen, electrical engineer; Dave Dube and Charlie Sperry, operations; Howard Gray, mechanical supervisor.; Robin Braido, instrument mechanic; Dan MacKay, area owner—converting; Earl Gibbs and Greg McLellan, machinists; and Roland Grondin, Papermakers Union president. Iver Iverson of NLK was project manager. Bill Verdi and Kin Sum of NLK provided construction supervision, and Rolf Lindfors also worked on the project.

The project was on time, on budget, and is meeting expectations. It also illustrates the success of the strategy that the employees of St. Marys achieve with this approach when executing projects.

|