|

Growing consumption in tissue markets is leading producers to expand at a rapid pace, but have they gone too far, too fast this time?

By Esko Uutela

Tissue producers sniff out the growth

Not a week seems to go by in the paper industry without another new tissue machine project popping up in the headlines. Papermakers are opting to install new tissue machines following strong growth in consumption in recent years. Global tissue consumption exceeded 19 million tons in 1998 and the next benchmark of 20 million tons is rapidly approaching. Tissue companies have been encouraged by new markets which are developing at a rapid pace and consumption growth has also provided producers with solid grounds for new investment plans in most of the world's regions.

Consumption is not the only area which has been expanding in the tissue sector though, the companies themselves have also grown considerably in size. In fact, the nature of the tissue business has changed radically during the past 10 years. The traditionally domestic market-oriented tissue business has developed into a regional, if not continental business. National players have expanded to become regional players, while regional players have made moves to achieve global player status.

However, continuing market growth is not the only key for success. The tissue industry, traders, distributors, machinery manufacturers and other participants in the tissue business are all facing new challenges created by increasingly competitive markets. Acquisitions and mergers between companies have generated additional pressure in the sector, particularly for small and medium size companies. Added to that, the fight within individual business segments is becoming extremely fierce in the more developed markets of North America and western Europe.

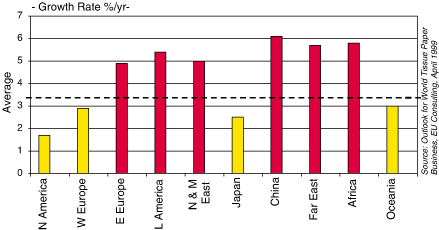

Figure 1 - Relative Growth Rates of World Tissue Demand by Region 1998-2010

Growing up

The growth of global tissue consumption has averaged 4.0%/yr throughout the 1990s. Tissue does not fall prey to very strong cyclical variations, but growth rates tend to follow general economic developments. The financial crises in Asia and parts of Latin America have clearly affected the growth of global tissue consumption over the past few years. In developed economies, tissue products are necessity purchases and their use is not strictly related to economic performance, but changes in purchasing power do tend to have an effect on which tissue qualities consumers purchase. In the away-from-home (AFH) sector, squeezed public and company budgets which are typical in periods of economic downturn, are reflected in tissue consumption.

Meanwhile, in the emerging economies there seems to be a certain threshold of economic development after which the growth of tissue consumption tends to accelerate, due to a deeper penetration of non-toilet tissue uses. Comparative research between regions and individual countries would suggest that this is a GDP level of $3,000 per capita.

There are good reasons to believe that long term growth prospects for worldwide tissue demand will remain healthy, although the global growth rate is gradually expected to slow down from 4.0%/yr to 3.0%/yr. Recent forecasts point to a 3.3/yr growth rate for the period 1998-2010. The main drivers of future growth in the worldwide tissue business will be:

- improved economic prospects in several world regions and slowing population growth which will lead to higher per capita income levels in the developing world. Rapidly emerging countries will exceed the "threshold" level of economic development

- in industrialized countries, there is a clear drive toward high quality products throughout all product categories. Changing product specifications and new innovations with superior characteristics will stimulate higher usage of tissue products.

On a global basis, average consumption of tissue reaches just 3.2 kg/capita. Regional consumption varies from more than 22 kg/capita in North America to a mere 0.4 kg/capita in Africa. The world average consumption per capita is low because the huge populations of Asia and Africa consume very little, if any, tissue paper. Despite a slowdown in relative growth rates, a further nine million tons/yr of tissue will be consumed in the world by 2010, compared to 1998 levels. Our forecast is not overly optimistic as the world average per capita consumption is not expected to exceed 4 kg/capita in 2010. This shows that a huge untapped potential still exists in the global tissue business. The highest relative growth rates can be found in China, Asia and Latin America and these regions will increasingly contribute to the global tissue market growth.

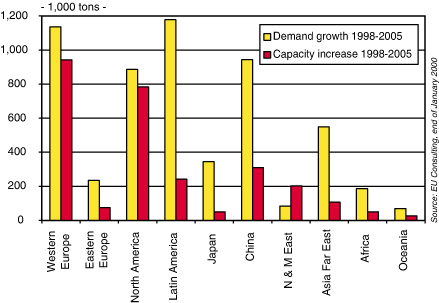

Figure 2 - Increase in Tissue Demand and Capacity by Region 1998-2005

New tissue capacity

Tissue makers have a number of new projects up their sleeves to meet the increasing demand from consumers. The list consists of more than three million tons of new capacity worldwide (including machines started up in 1999). Depending on the region, the supply/demand outlook varies considerably. In western Europe and North America, projects in the pipeline already account for more than 80% of the expected demand increase until 2005. In the Middle East, where markets are rather small, a few projects are likely to cause an oversupply situation around 2000 and exports of parent reels from the region will continue. In other world regions, the demand/supply situation seems to be more balanced, while new investments will be needed in other regions, eg in eastern Europe.

More than 900,000 tons of new tissue capacity is scheduled to start up in western Europe in 1999-2002. On top of that, a number of additional projects are on the drawing board which could potentially start up toward the end of this period. New investments have picked up pace following strong growth in western European tissue consumption, which was in the range of 5.0%/yr in both 1997 and 1998, and provisional estimates for 1999 suggest the growth to have continued at an only slightly lower level of 4.5%/yr. For the next few years though, growth is expected to slow down somewhat. Investments will peak in 2000, with most of the capacity increases coming on stream from late 1999 to late 2000.

The demand/supply outlook indicates that there will be tough competition in the western European market over the next few years. But it should be noted that rationalization and restructuring measures will certainly continue in the tissue industry. Major players are likely to shut down some of their weakest operations and consolidate their business into larger, more competitive mill units. It is also obvious that some small producers will have to sell their mills, or wholly exit the tissue business for competitive reasons. Typically, mill or machine closures are not announced a long time in advance, so relatively few machine/mill closures are shown on the capacity change list. This means that the net capacity change shown in Figure 2 could be less than indicated. In addition, the market balance will be positively affected by increasing tissue product exports to eastern Europe.

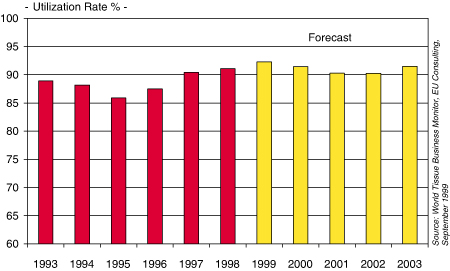

Strong tissue demand growth in 1997-1998 and relatively few tissue machine startups in 1996-1997 led to high capacity utilization rates of 92-94% in 1998-1999. But massive capacity investments will reduce the capacity utilization rate in 2000-2001, and it may fall close to the 90% benchmark.

Figure 3 - Capacity Utilization in the Western European Tissue Industry 1993-2003

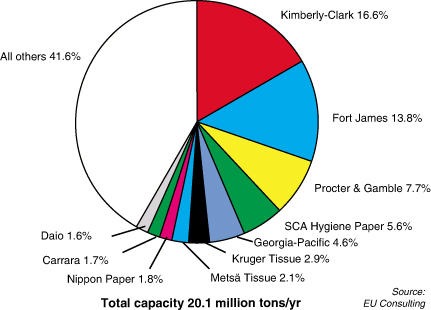

Size matters

The world tissue industry consists of more than 700 mills, with some 1,400 tissue machines in operation reaching a total capacity of 20 million tons. Although the number of players in the world tissue industry is high, a few companies dominate the business. The top five companies control more than 48% of worldwide capacity, while the top ten suppliers have a hold over 58%. Recent mergers have resulted in further concentration of the tissue industry, with Kimberly-Clark and Fort James clearly holding the #1 and #2 spots among tissue companies. However, only Kimberly-Clark can boast that it operates tissue units in all the continents.

There is also reason to believe that the concentration trend will continue and intensify worldwide. SCA of Sweden and Procter & Gamble seem to be well on the way to becoming global instead of regional players. SCA's first priority is in western Europe where it is strong in all other markets than Italy, but the company also has the intention to conquer this market. Procter & Gamble has focused on the kitchen towel market in Europe with its "Bounty" brand. We expect the company will also launch its strong bathroom tissue brand "Charmin" in Europe shortly, probably starting in the UK market.

Georgia-Pacific snapped up Wisconsin Tissue recently but the company so far remains as a North American tissue supplier. Meanwhile, Italian companies now have their main focus for growth on France, Spain, UK and Germany, as well as the emerging eastern European markets. Metsä Tissue's recent acquisitions in Poland and Germany also show an increased interest to expand outside the Nordic countries. And in Asia, APP's four new large tissue machines in Indonesia and China make the company the second biggest tissue supplier in the region, behind Kimberly-Clark.

Tight supplies in North America

In 1997-1998, the North American trade balance in tissue showed a deficit of 30,000-40,000 tons/yr and it is estimated that net imports have risen to over 80,000 tons in 1999. Canada is a strong exporter to the USA, but the country also sources part of its tissue needs from Mexico, Brazil and Colombia, and more recently, from Asia. The tight supply situation in 1997-1999 was mainly caused by the mill and machine closures that occurred as a result of the consolidation activities of Kimberly-Clark and Fort James. The shutdowns effectively counterbalanced new capacity additions in the period from late 1997 to mid-1998. Overcapacity as such was not behind the mill closures. The market leaders increasingly need to operate new machines based on modern technology in order to remain competitive, rather than running their old, often smaller and slower, tissue machines.

New capacity which came on stream in 1999 did ease the tight supply situation and last year the industry saw an effective capacity increase of some 400,000 tons. However, capacity utilization remained high due to an increase in demand caused by the very strong US economy. This situation has given Latin American suppliers the opportunity to continue exporting parent rolls to the US market. In general, there are also opportunities for local investors in the tissue industry to grow in the face of competition from the multinationals. This has been shown by a number of new investors basing their activities on niche markets which are not attractive to multinationals. In general, North American tissue companies seem to take into account market developments and introduce new capacity in the market place in a disciplined manner, so that the supply/demand balance is not seriously disturbed.

Figure 4 - World Capacity Shares of Leading Tissue Suppliers

Soft landing

All in all, the tissue sector continues to be a growth industry worldwide, offering new opportunities for companies to expand. The long term expansion potential is good, though medium term prospects are somewhat shadowed by economic turbulence that has occurred in several regions. The market outlook varies substantially depending on the world region. Heavy investments in additional tissue making capacity, particularly by Italian suppliers, are likely to cause tough competition in western Europe. In North America, capacity additions seem to be carried out in a more disciplined manner. China and Latin America show good long term potential, while in Asia much will depend on the level of recovery in the region's economies. Both in western Europe and North America, there are competitive challenges for tissue suppliers and machinery manufacturers in quality development, particularly in the consumer sector products. Along with higher efficiency requirements, companies will also find new challenges in tissue machine design and converting line productivity.

Companies that grasp the importance of these issues and act upon them will be the winners in the tissue business and they will go ahead to reap the benefits of this growth sector.

Esko Uutela is the general manager of EU Consulting in Germany and publisher of "World Tissue Business Monitor". He can be contacted on +49 8151 29193 (Tel), +49 8151 29183 (Fax) or via e-mail at euco.uutela@t-online.de

|