What is the outlook for tissue?

by Pekka Niku

Players in the tissue market could look to expand in the future, according to the latest figures

The value of the global tissue paper business is $30 billion, and the volume is over 20 million tonnes. North America and Europe account for over 60% of consumption. In the 1990s, the global market grew at a rate of close to 4%/yr.

World average per capita consumption of tissue paper is 3.4 kg. The differences between regions are huge. Per capita consumption levels are highest in North America (22 kg), western Europe (13 kg) and Japan (over 13 kg). In China, other Asia and Africa, the consumption levels are 2 kg or below. The figures show that the global tissue business has much potential to grow in the future.

|

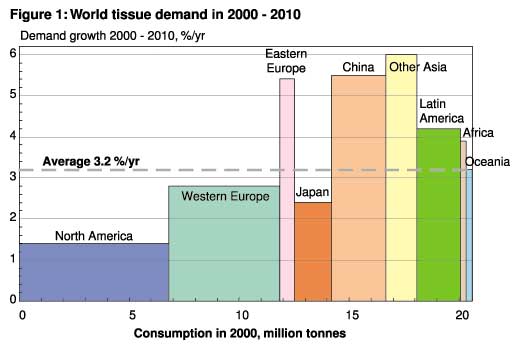

World tissue paper demand is forecast to grow by 3.2%/yr up to 2010. The annual increase is about 780,000 tonnes, and the market is expected to reach 28.3 million tonnes by 2010. The growth corresponds to the combined capacity of 26 medium-size (30,000 tonnes/yr) or 13 large (60,000 tonnes/yr) tissue machines per year. Growth prospects are best in China and other Asia, where economic growth, rising standards of living, rapid growth of travel, hotel businesses and fast food chains all contribute to the demand growth. The eastern European market is also likely to grow clearly above average during the next 10 years.

Variation in consumption

Tissue paper consumption patterns vary between regions. Toilet paper is the main product in all regions except the Near and Middle East, where facial tissue dominates for religious and cultural reasons. The share of toilet paper is lowest in North America (40%); in Western Europe it is about 50%. In the main consuming regions, demand for toilet paper is expected to grow slightly below average. The growth will be fastest in toweling (kitchen rolls, industrial towels and wipes) and napkins.

The tissue paper market is normally divided into two main segments: AH (At Home or consumer segment) and AFH (Away-from-Home or institutional segment). The AFH segment is most developed in North America, where it accounts for 38% of tissue consumption. In Western Europe it accounts for about 35%. In most other regions, the share of the AFH segment is still less than 10%, but it offers good growth prospects.

Tissue paper is a consumer product, and branding is a vital part of its marketing. In addition to manufacturers' brands, the leading retailers have introduced their own private-label brands. In Western Europe, about half of all consumer tissue is sold under private labels. In some countries like Germany and Switzerland, the share of private labels is already well over 60%. In North America and many other regions, the share of private labels is much smaller, though gradually increasing. The consolidation and globalization of retail chains support this development. The trend toward private-label products results in increased price pressure and forces tissue producers to improve their cost efficiency.

Consolidation will continue

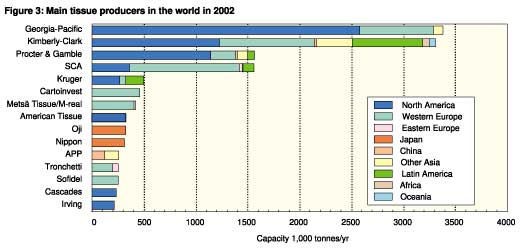

The tissue industry is highly concentrated and integrated with tissue converting. The top five producers account for about half of global tissue capacity. The concentration level is highest in North America, where the top five producers account for some 80% of the capacity. In North America and Western Europe, well over 90% of the tissue production is integrated with converting. The leading producers are global players with tissue production and converting in several regions/countries.

|

Not only the tissue industry, but the whole value chain of the tissue business is more consolidated than that of many other paper products. Industry structure in many parts of the chain is oligopolistic. The top five companies account for 40-50% of the business, which includes companies from market pulp suppliers to tissue converters, as well as suppliers of tissue paper machines and converting machinery (where the consolidation is highest). In the retail trade, the consolidation is somewhat smaller, with the top five companies accounting for 30-35% of the trade in Western Europe and North America, though their share is continuously increasing. The increasing consolidation adds stability to the business, but also limits the choices for tissue manufacturers as regards raw materials and machinery, while boosting customers' (and therefore retailers') purchasing power.

|

|

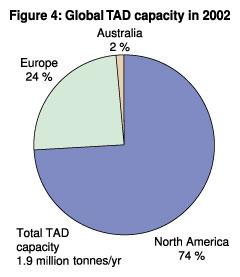

Consumer preferences differ widely between regions and countries, making tissue paper production and converting more complex. Both papermaking and converting technology is being developed to fulfil the increasing need for higher quality. Through-air-drying (TAD) has played an important role in improving tissue quality. TAD is increasingly applied on new paper machines to achieve higher softness, bulk and absorbency.

TAD technology was long protected by patents and used only in the US by companies such as Procter & Gamble, Kimberly-Clark and Scott Paper during the 1970s. In the 1990s, this technology was introduced to the European market. Currently, the global TAD capacity is about 1.9 million tonnes, which is still less than 10% of world tissue capacity.

In the short term, slow economic growth and expansion of the tissue capacity especially in Europe will be the main concerns of the industry. In the longer term, growth, change, product development and competition will be the key characteristics of the tissue business. Strategic decisions and optimization need to be made at several levels, from market and product selection to branding, integration with converting, manufacturing technology and fiber mix/sourcing. Companies will need to improve their overall cost efficiency to maintain their competitiveness in the business.

Pekka Niku is senior consultant at JP Management Consulting (Europe). This article is based on a 400-page multi-client study, Tissue Business - Global Outlook up to 2010, published by Jaakko Pöyry Consulting in December 2001.

For further information, please contact Pekka Niku or Ritva Carvalho:

phone: +358-9-89471, fax: +358-9-878 2482, e-mail: consulting@poyry.fi

|