Jumping a sinking ship?

by Kate Perry,

News editor

Industry analysts are thin on the ground in Asia. Is this due to past events or do they have an inkling of things to come?

Looking at the spate of new machines, capacity expansions and plans for further growth in Asia's pulp and paper market, observers could be forgiven for thinking the region is in the middle of a boom. According to data compiled by PPI Asia News, more than 2 million tonnes of new capacity came on stream in China alone during 2000-2001, with plans afoot to boost the country's paper and board capacity by a further 4 million tonnes by the end of 2003.

But according to an Australasian-based paper analyst, the capacity explosion may be more a signal that pulp and papermakers are staking a claim in their local market rather than a sign of increased demand. The analyst says that in a large number of cases expansions occurred because local producers wanted to supply their domestic market, which may have traditionally been fed by imported paper or board. He adds that many Asian producers tend to look first at what is beneficial to their company or country, instead of focusing on the impact of capacity expansions on the global industry. "China needs to replace old, inefficient paper mills and is replacing them with big, more efficient ones. It's the right thing to do from their [producers'] perspective - but what happens in China will affect producers elsewhere."

While Asian manufacturers look to fill domestic demand with local products, the analyst says that economies of scale often mean that machines are bigger than necessary to meet local needs, causing producers to export excess tonnage. In such cases, foreign producers are suffering on two fronts - an erosion of their traditional market in Asia and increased paper and board from the region making its way onto the export market.

But it is not all doom and gloom for exporters to Asia. Since joining the World Trade Organization (WTO) at the end of last year, China and Taiwan have had to revamp their import tariff systems and reduce tariffs with the ultimate aim of abolishing them completely (PPI, November 2001). Taiwan announced its intention to abolish all import tariffs by 2004. China has not been as publicly specific, but has embarked on a scheme that will see its import tariffs steadily decrease over the next few years. Its pre-WTO import tariff level of 15% for containerboard, woodfree paper, lightweight coated paper and tissue will drop to 8-12% this year.

One grade where exporters to Asia are feeling the pinch caused by increased local capacity is printing and writing paper. According to one analyst, while Asia is still a net importer of printing and writing paper, the increase in local capacity has seen import levels drop. "Historically Europe and the US have been able to offload their excess tonnage in Asia, but it's becoming more difficult to find a market."

Asia's containerboard market is also tightening, as local suppliers crank up capacity in a huge way. Dongguan Nine Dragons started up a 400,000 tonne/yr containerboard machine at its mill in Dongguan, Guangdong province, in late 2001 and plans to bring a second 400,000 tonne/yr unit on stream in the second half of this year (PPI, August 2001). On top of that, Lee & Man also aims to start up a 330,000 tonne/yr containerboard machine in the province at the end of the year. The Australasian analyst says that China's ballooning containerboard capacity was doing much to offset the benefits of consolidation in the US containerboard industry. "I'm not sure that consolidation can resolve the oversupply issue. There needs to be a lot of consolidation to see an impact."

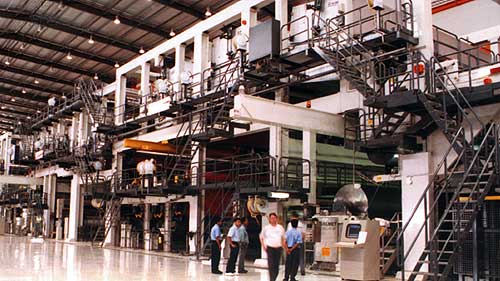

Many of China's new machines will be bigger than necessary causing producers to export |

China's pulp and paper mills are notoriously overstaffed and often labeled inefficient. Figures from PPI's Annual Review 2001 (PPI, July 2001) show that in the year 2000, Japan's 44,000 industry workers produced 31.8 million tonnes of paper and board at 44 mills. China churned out some 31 million tonnes of paper and board, but it took 1.18 million employees and an estimated 5,000 mills to do the job.

Despite the new technology employed by China's mills in the form of new units, the Australasian analyst is not convinced that the country's raft of new machines could all be profitable. But he adds that the situation would not necessarily deter further expansions. "In theory, a company which fails to achieve cost of capital has to shut down. But this doesn't seem to be the case in the Asian pulp and paper market," he comments.

A case in point is the Singapore-headquartered Asia Pulp & Paper (APP), one of the region's largest producers, which is still producing pulp and paper at it mills in Indonesia and China despite crippling debts. The financial collapse of the pulp and paper giant caught the industry by surprise and burnt hundreds of investors. The group is currently trying to negotiate a plan with creditors to restructure its $12.2 billion debt. Disgruntled creditors were unhappy with the first draft of the plan they were shown at the beginning of February, putting in jeopardy the group's hope of presenting a final restructuring proposal in March. But money problems are not APP's sole concern. Apart from its financial woes, the group faces a slew of civil law suits in the US and a criminal investigation by Singapore's Commercial Affairs Department. Despite the turmoil, the group's pulp and paper mills are still operating, albeit on a cash-only basis with raw material suppliers now reluctant to trust credit transactions.

Indonesia's Asia Pacific Resources International (APRIL) is also facing massive debts and is currently working out a plan to restructure some $1.2 billion of debt. The company's financial problems forced it to withdraw from an alliance with Finland's UPM-Kymmene over Changsu fine paper mill in China in late 2000 and a year later saw its stocks delisted from the NYSE (PPI, February 2001).

These financial blowouts have had a ripple effect on investors, causing many to shy away from the sector. In fact, investor interest in Asian pulp and paper has weakened so dramatically that a number of investment houses no longer employ specialist region-wide analysts. Some have dropped pulp and paper research altogether, while others limit their work to specific companies or countries. BNI Securities is one investment house that no longer covers pulp, paper or forestry, while other investment houses which are scaling back sector coverage include Credit Suisse First Boston, Merrill Lynch and Salomon Smith Barney.

The role of foreign companies

Added to a new sense of nervousness about doing business in the region in the current financial climate, the rash of new capacity being brought on stream by local producers could have an effect on the business decisions of foreign players. For example, newsprint producer PanAsia was recently granted approval by the Chinese government to install two new 200,000 tonne/yr newsprint machines, one in Shanghai and the other in Hebei province. But the company, which is jointly owned by Canada's Abitibi-Consolidated and Norway's Norske Skog, has not yet committed to going ahead with the project.

In a similar vein, Stora Enso remains quiet on whether it plans to go ahead with a scheme to add a further 500,000 tonnes/yr of coated woodfree capacity to its Chinese operations. The company is the majority owner of Stora Enso Suzhou Paper, which has applied to the Chinese government for permission to install the extra woodfree capacity. The company applied for permission at the end of 2000, but the approval process can take up to three years and there is no word yet on whether the scheme will be given the go-ahead. Stora Enso Suzhou currently produces 150,000 tonnes/yr of coated woodfree paper at its mill in Suzhou, near Shanghai.

Fellow Finnish giant UPM-Kymmene owns a 350,000 tonne/yr printing and writing paper mill in Changshu, eastern China. The Changshu mill was originally a joint venture with Indonesia's APRIL, but financial difficulties saw APRIL pull out of the deal in August 2000.

Moving closer to home, one outsider that is making aggressive expansion plans for the region is Japan's Oji Paper. The group has outlined a scheme that would see it add 1 million tonnes of paper and board capacity to its Asian operations outside Japan over the next four years. Oji has set up a special unit, called the Asian Research Center, to promote the expansion which the group aims to carry out through a series of mergers, acquisitions and greenfield mills. According to details released in August 2001, the extra capacity will include 500,000 tonnes/yr of coated and uncoated woodfree paper, 200,000 tonnes/yr of newsprint or lightweight coated paper, 150,000 tonnes/yr of board and 150,000 tonnes/yr of specialty paper.

Japan is the largest single market in Asia, with an apparent per capita consumption level of 250.1 kg/yr compared to China's apparent per capita consumption of 28.3 kg/yr. But a report released by JP Morgan late last year said that the country's growth potential is negligible, prompting Japanese firms to look offshore to expand. "While Japanese companies have led development of the Asian sector over the past 50 years, growth options within Japan appear increasingly grim as domestic demand slides and import competition gains ground," according to the report.

APP is looking to expand |

Salomon Smith Barney analyst for Japan, Paul Blamire, agrees with this view, saying that although Japanese producers could look to boost earnings through cost cutting efficiencies over the next couple of years, beyond that there would probably be a need to look offshore for growth.

According to Blamire, the area of most interest to Japanese companies is China, but he added that the country's pulp supply problems would need to be addressed to make it viable. "There is almost no cost advantage to producing paper in China is there if no pulp supply," he says.

China relies heavily on raw material imports, a reliance which has risen in tandem with its increased paper capacity. In fact, recent figures released by Chinese Customs show that while imports of paper dropped during January-November 2001 compared to the year earlier period, raw material imports rose. The volume of recovered paper imports was up 75% on 2000, while the volume of pulp imports rose 43% on the previous year. By contrast, corrugated paper and board imports fell 33%, newsprint imports were down 23% and imports of kraftliner and kraft paper slipped 17%.

The Chinese government and local companies are exploring ways of increasing the country's supply of raw material. This includes plans to boost the size of the country's forests. Yueyang Paper plans to establish 40,000 ha of poplar by 2005, while Ningxi Meili aims to expand its 1,300 ha of poplar plantation to 33,000 ha.

There are also at least two new pulp lines slated to come online over the next two years. Shandong Rizhao expects to bring a 170,000 tonne/yr bleached kraft pulp line onstream by the middle of this year and Guangxi Lipu plans to start up a 50,000 tonne/yr unbleached softwood kraft pulp line by the end of 2003. The largest planned pulp project in China, which was to be undertaken by APP, has an unclear future. APP has planted eucalyptus to feed a planned 600,000 tonne/yr pulp mill on Hainan island in southern China. But the company's bleak financial situation has meant the project was officially postponed in late 1999 and no startup date has since been announced.

Other pulp expansions in the pipeline for the region include a 750,000 tonne/yr bleached hardwood kraft pulp line to be built in Sarawak, Malaysia. The Sarawak government revived the scheme last year, after putting it on ice when the Asian crisis struck in 1998. The government has said that the new pulp mill will start production by the end of 2004.

Investors wary of Indonesia

Before APP and APRIL cast a dark shadow over the Indonesian market, the country was seen as an attractive region by foreign investors. But times have changed and one Jakarta-based analyst said that there was so little investor interest in Indonesian companies that nobody bothered covering them any more. However, it is not just financial concerns that have caused the shift. Increasing political instability and environmental pressure that is threatening wood supply have also contributed to waning investor interest.

JP Morgan attributed the rapid growth of Indonesian-based pulp and paper manufacturers for the country's current problems, saying that Indonesia's production capacity has more than quintupled in the past decade. "Rapid expansion in the past decade has jeopardized the competitive position of a country blessed with a large, cheap, fast growing fiber base and proximity to large markets," stated the report.

One analyst says that papermakers are likely to be forced to look outside Asia toward places such as Latin America to fill their growing pulp needs.

A Jakarta-based analyst is confident that paper company stock prices will see a resurgence in the next 6-12 months, with paper and pulp prices also set to improve. Beyond that, however, he says it is difficult to tell what the future holds.

"Some analysts are bullish about the pulp and paper market," another industry observer comments. "You can be bullish if you take a 6-12 month view, but anything longer and you can't be, because the cycle will repeat itself." He fears that even a general economic recovery would not have a huge influence on the pulp and paper industry, saying that pulp and paper prices were under pressure 12 months ago, before the dip in the global economy.

One thing is certain, though. In the wake of the unexpected financial problems of the regional giant, APP, investors are demanding more transparency. Analysts say that in these difficult economic times only companies with strong balance sheets will be able to thrive and survive. "Transparency has become more important. Rather than relying on investment houses to broker deals, investors want to take a closer look below the surface," says one researcher.

|