|

| SWEDEN |

|

Assi deals cash for sacks

AssiDomän has reached a deal to sell its barrier coating, sacks and kraft products businesses to Austria’s Frantschach.

The two companies have signed a letter of intent for the cash sale of the divisions. The deal includes AssiDomän's Dynäs mill in Sweden and the Sepap mill in the Czech Republic, as well as its sack converting and barrier coating operations. The Swedish producer’s plants in Karlsborg and Skärblacka are not included in the transaction. If the deal goes ahead, Frantschach will become the new owners of assets that have a combined turnover of Euro 650 million ($637 million). The transaction is subject to a due diligence period, as well as negotiations concerning the final agreement.

Sawmills axed: AssiDomän has also sold its Niab Hestra subsidiary and Hestra sawmill to the Swedish group, Vida. AssiDomän's strategy for timber and wood products is to focus mainly on pine or red wood. Hestra is exclusively a spruce (white wood) sawmill and Niab’s processing is focused on white wood products.

Boxing clever: AssiDomän is merging two of its corrugated box production units in Spain. The existing plants in Huelva and Sevilla will be moved to a new 75-85 million m= facility, which is to be built between the two cities. AssiDomän plans to invest Euro 9.1 million ($9.1 million) in the new plant. Construction will begin in the middle of this year, with startup due at the beginning of 2001.

|

| FINLAND |

|

Metsä-Serla Sees market for coated papers

Metsä-Serla is planning to switch production on PM 4 from uncoated to coated woodfree paper at its Kangas mill in Jyväskkylä, Finland. The investment is part of the Finnish producer's strategy to focus on coated paper production.

The upgrade of 180,000 ton/yr PM 4 will be completed by the end of 2001. PM 2 at the Kangas mill, which produces coated woodfree and specialty papers, has also been booked in for a small-scale upgrade. After the rebuild, PM 2 will no longer produce specialty papers.

Uncoated paper production will be continued at the company's other units, Biberist in Switzerland and the New Thames mill in the UK.

|

| FRANCE |

|

French face up to storm damage

French producers are coming to terms with the aftermath of the vicious storms that swept through the country late last year. One of the worst hit mills was Sofidel’s Delipapier greenfield site in Frouard. Barely two weeks after the new tissue mill started up on 8 December, the storm destroyed the plant’s dryer hood, yankee dryer and reels. The mill was working on a solution to restart production in mid-February.

Another mill which was badly damaged was MoDo's Alizay mill, where the wood chip conveyor toppled over and forced the pulp mill to shut down. MoDo managed to restart normal pulp production in mid-January though. The mill estimates that between 26 December and 10 January, operating losses reached FF 2.5 million ($385,800) per day.

Production also came to a halt for just over two weeks at the Greenfield deinked market pulp mill due to an electricity shortage. As a result of the shutdown, the mill lost around 3,500 tons of pulp production. But since the middle of January, the Greenfield mill has been operating normally.

AWA has rethink on Guérimand

Arjo Wiggins Appleton (AWA) is rethinking its strategy concerning the 100,000 ton/yr Guérimand mill in Voreppe, France. Rather than selling off the site, AWA plans to form a joint venture with Matussière et Forest to run the operation.

Under the deal, AWA will reduce its stake in the French mill to just 40%, while Matussière et Forest will buy up the remaining 60% of Guérimand's shares. One source at AWA confirmed that its new partner is to invest some FF 200 million ($31 million) in the Guérimand site. The cash will go toward helping Guérimand switch production away from 100,000 tons/yr of carbonless copier and uncoated woodfree printing/writing paper toward recycled paper grades.

|

| GERMANY |

|

Metsä Tissue sells German unit

Metsä Tissue has sold its Hedwigsthal mill in Germany to a group of private investors. The plant at Raubach makes feminine hygiene products. The disposal follows the company’s decision to focus on tissue products.

Hedwigsthal has an annual turnover of Euro 15 million ($15 million). The mill’s new owners have leased the site's production facilities and say they will continue to produce feminine hygiene products. Metsä Tissue does not expect the sale to have any significant effect on the company's financial results this year.

|

| PORTUGAL |

|

Portucel plans sack spin-off

Portucel Industrial has created a new corporate vehicle for its kraft sack businesses called Companhia Produtora de Papel Kraftsack (CPK). The Portugese group aims to add value to its kraft sack business by reorganizing CPK in line with Portucel Tejo, the unbleached softwood pulp arm of the group. The new kraft sack company and the pulp producer will look at possible synergies through the creation of a vertically integrated group. The unit is 100% owned by the group, but Portucel plans to privatize CPK once restructuring is complete.

Portucel is also carrying out an upgrade at its Cacia mill to allow the plant to switch production from unbleached kraft pulp to bleached kraft pulp. Output is set to increase from 600 tons/day to 800 tons/day after the upgrade. Work began on the project at the end of last year and should be complete in the second quarter of 2000. Kvaerner Pulping is to rebuild the bleach plant as well as supplying new equipment. ABB will extend the mill's existing Flakt dryer to increase drying capacity by 30%.

|

| SWEDEN |

|

Klippan's board throws in towel

Klippan’s managing director has resigned and the company’s entire board of directors has put itself up for re-election following a change in ownership structure.

One source said the upheaval began when Jan Bernander increased his stake in Klippan from 16% to 25% to become the largest shareholder. The change in ownership structure prompted massive speculation in Sweden over the company’s future.

Bernander has called for an extraordinary general meeting that will see the election of a complete new board for the specialty paper producer.

Modo says time to go for Domsjö

MoDo has sold off its sulfite pulp mill in Domsjö to Domsjö Fabriker, a privately owned company in Sweden. The purchase price is set slightly higher than the SEK 250 million ($30 million) capital that is currently employed in the business. MoDo said the effect on the group’s financial results for 1999 will be limited.

Stora Enso stops board at Mölndal

Stora Enso is to halt board production at its Mölndal mill in Sweden in April. The closure of the 45,000 ton/yr board PM at Mölndal will allow the mill to concentrate on coated and uncoated woodfree production.

Stora Enso said the production shift was necessary to safeguard the mill’s profitability. The board PM is considered too small to be competitive and will be scrapped following its closure. The group revealed that it has spent the past year trying to sell the Mölndal mill as a complete unit. But the offer has not attracted any buyers that would be willing to take over both paper and board production at the Swedish site. Stora Enso said it will hang onto the mill for at least one year following the closure of its board PM, before deciding on Mölndal's long term future.

|

| UK |

|

SCA sells Scottish unit

SCA Packaging is to shed its folding carton unit in the UK. The US company, Chesapeake, is to take over the business in Glasgow via its European specialty packaging subsidiary, the Field Group. A spokesman for SCA explained that the business no longer fits in with the group’s strategy, which is to focus on corrugated packaging rather than folding cartons. SCA acquired the business in February 1999 from Rexam. The sale is expected to close in the first quarter of 2000.

|

| LATVIA |

|

Milmans looks at tissue

Milmans Paper is weighing up plans to invest in tissue production at its Jaunciems paper mill in Latvia. The tissue would be converted into bathroom tissue and paper towels.

The proposed project would be carried out in two stages. First, the company would set up a tissue converting operation, producing finished goods from jumbo reels purchased from suppliers in neighboring countries. Stage two of the project would involve manufacturing tissue from locally collected wastepaper.

Latvia makes progress on pulp

Latvia's government has approved the terms of a shareholder agreement geared toward forming a pulp mill project company. The new joint stock company will consist of three parties - the Latvian state, Metsaliitto and Sodra Cell. The company will be based in Riga. The project team's main tasks will include obtaining environmental and construction permits and looking at funding issues. The pulp mill is likely to be situated in central Latvia between Jekabpils and Livani. Capacity is estimated to be 600,000 tons/yr of bleached softwood kraft pulp.

|

| LITHUANIA |

|

Pulp mill stays on track

Lithuania's economic ministry has staunchly denied that it has postponed plans to build an 800,000 ton/yr pulp mill in the country. The ministry has even added the concept of building a paper mill to its agenda. A government source sparked off the rumor at the end of last year when he said that the project had been put off until a later date. The country’s new government is looking at other state investment projects first, he said. But the economic ministry refutes the speculation and said that it signed off a "scope of work" document for a study on Lithuanian pulp and paper industry development at the end of last year. The agreement was signed with the Japan International Cooperation Agency (JICA) and is due for completion by the end of this year.

|

| GERMANY |

|

Mercer plans second pulp mill

Mercer International is set to invest in a 550,000 ton/yr kraft pulp mill in Germany, which could lead to the company exiting papermaking altogether to concentrate on pulp. Mercer has entered into an agreement with Zellstoff Stendal to build a pulp mill in the Sachsen-Anhalt area of Germany. The company has initially subscribed to a 25% interest in the Stendal project company and intends to increase this stake to 51% for an additional contribution of $42.6 million. The increase in ownership is subject to certain conditions though, including formal shareholder approval and the completion of due diligence.

Stendal has already received the necessary permits for the $790 million mill construction project, as well as commitments for German state and federal subsidies and grants. Work on the project is due to swing into action at the end of this year. Startup is planned for 2003.

Zellstoff Stendal was formed by Thyssen Rheinstahl Technik, a subsidiary of ThyssenKrupp of Germany and Tessag Industrieanlagen.

|

| SWEDEN |

|

MoDo/SCA deal out shares

MoDo and SCA are hacking back their 50/50 shareholding in Modo Paper to just 15% each. The move has prompted speculation over the identity of a potential new owner.

SCA aims to broaden Modo Paper's ownership base by selling 35% of its shares via a public offering. MoDo will distribute a similar portion to its own shareholders.

One analyst said that SCA is likely to give up the rest of its shares in Modo Paper to concentrate on its core businesses. SCA's initial 35% stake that is up for grabs may be an attractive acquisition for several big names in the paper industry.

The move to attract additional owners for Modo Paper comes just ahead of the new company’s listing on the Stockholm stock exchange. MoDo and SCA are preparing the ground for their jointly owned company to be listed in April this year.

|

| ROMANIA |

|

Romania picks up privatization pace

The Romanian State Ownership Fund (SOF) is inviting offers for a 70% stake in the pulp and paper producer, Somes Dej. The sale was supposed to kick off last year, but the SOF opened the sale by a direct negotiation process in mid-January.

The SOF said that the majority stake is worth Lei 61.6 billion ($3.5 million). Bidding was due to close at the end of February.

|

| RUSSIA |

|

Vyborg resolves violence at mill

Vyborg aims to restart pulp and paper production at its mill in Russia following a long term dispute between the workers and owner.

Security personnel working for the factory’s British owner, Alcem UK, have ousted the Russian strikers that have kept the mill out of action for more than one year. Sources said the hard-core group was protesting against privatization plans that could lead to severe job losses at the mill under a restructuring scheme.

The acting general director of Vyborg Cellulose planned to restart the plant in February. Alcem UK has sufficient distribution channels to make it worthwhile restarting output at the troubled site, he said. Alcem UK’s next task is to appoint staff and a management team to run Vyborg.

|

| ISRAEL |

|

Shaniv sets out plans

Shaniv Paper Industries plans to invest in a new tissue machine for its Ofakim mill in Israel. The PM will be the mill's third tissue machine. PM 3 is to have a capacity of approximately 25,000 tons/yr. The new machine will be slightly faster than the mill's existing Valmet PM, which has a design speed of 1,600 m/min. Trim width will be 2.7 m.

According to Izhar Shiff, the company's managing director, Shaniv plans to pick a supplier for the new PM by the end of the first quarter.

|

| TURKEY |

|

Katronsan delays pm project

Kartonsan has gone back to the drawing board with its plan to build a new cartonboard machine at the Izmit mill in Turkey. The company had developed an outline scheme to increase its cartonboard output by 100,000 tons/yr to 250,000 tons/yr by installing a third BM.

But Kartonsan said that it is still looking at the whole concept of investing in new equipment, including the choice of suppliers and precise location for a new unit. The company gave 2002 as a likely startup date if the project goes ahead.

Kartonsan originally aimed to get a new 150,000 ton/yr board machine up and running this year. But the expansion scheme has been stuck at first base since 1997.

|

| CHINA |

|

Dong Guan goes for new PM

Dong Guan Nine Dragons’ main shareholder, America Chung Nam (ACN), is to invest a further $100 million in the Chinese packaging company. The funds will be spent on a 400,000 ton/yr corrugating medium machine. The move is the latest stage in the company’s aim to hit a one million ton/yr production target by 2001.

The latest proposals replace original plans to build a 150,000 ton/yr corrugating medium PM. Startup is penciled in for the first quarter of 2001. Separately, ACN has targeted tissue converting operations as a second core business area. At a recent board meeting, the company announced plans for a $10 million venture in baby diaper and feminine hygiene product operations in Dong Guan, China.

|

| ITALY |

|

Ahlstrom buys up all of Ascoli

Ahlstrom Paper has increased its stake in Italy’s Ascoli Paper from 40% to 100%. The 85,000 ton/yr Ascoli mill will operate as part of Ahlstrom Paper’s label and packaging division under the name Ahlstrom Ascoli. The Italian mill produces mainly medium weight coated (MWC) publication paper that is used in the graphic paper industry. Ascoli operates one 3.8 m wide PM as well as an off-machine blade coater. Ahlstrom Paper bought the remaining shares in Ascoli from a consortium of three Italian commercial banks - Banca Commerciale Italiana, Interbanca and Mediocredito Lombardo.

Spending spree: Ahlstrom Paper is also investing Euro 16.5 million ($16.2 million) at the Ascoli mill. Honeywell-Measurex is to supply an automation system as part of the project. The rebuild is due to be carried out in September, ready for a restart at the beginning of October.

|

| KOREA |

|

Hankuk plans pm investment

Hankuk Paper of Korea has decided to spend $63 million on a new coated woodfree machine for its Onsan mill. The PM will have an 80,000 ton/yr capacity and produce paper in a basis weight range of 80-320 g/m2;. Installation work is scheduled to start in November this year, with startup planned for November 2001.

Hankuk Paper’s latest scheme replaces original plans to install a 240,000 ton/yr lightweight coated (LWC) machine. Hankuk Paper also closed its 80,000 ton/yr Anyang mill in September 1998 and the company was keen to point out that the new capacity would simply replace the tonnage from this closed mill.

|

| JAPAN |

|

Oji invests at Fuji mill

Oji Paper is to invest Yen 25 billion ($236 million) in a new white board machine for its Fuji mill in Fuji City, Shizuoka. The 650 ton/day PM is scheduled to start commercial production in October 2001.

Oji ordered the PM from Voith Sulzer, while Kobayashi Engineering Works will deliver the cylinder dryer. Mitsubishi Heavy Industries is to supply the winder.

The machine will be the widest white board PM in Japan, with a wire width of 4.7 m. The unit will also be the world's fastest white board machine with a design speed of 800 m/min, the company claims. There will be little change in the company’s net capacity as several old machines will be shut down.

|

| Brazil |

|

VCP sells stake in Salto

Arjo Wiggins Appleton (AWA) has bought out the 51% share that Brazil’s Votorantim Celulose e Papel (VCP) held in Industria de Papel de Salto. The Real 42 million ($23 million) deal makes AWA the full owner of the security paper mill in Sao Paulo state, Brazil.

The Anglo-French group plans to use Salto as its main platform for growth in Latin America.

|

| EL SALVADOR |

|

K-C invests in new PM

Kimberly-Clark (K-C) is splashing out on a new machine for its mill in La Libertad, El Salvador. The tissue machine will be supplied by the Italian company, Overmeccanica.

The crescent former machine’s capacity is set to exceed 100 tons/day. Design speed will be 1,800 m/min with a trim width at the reel of 3.3 m. Overmeccanica plans to complete the construction of the PM by July this year, with startup planned for October. The mill already operates two machines.

|

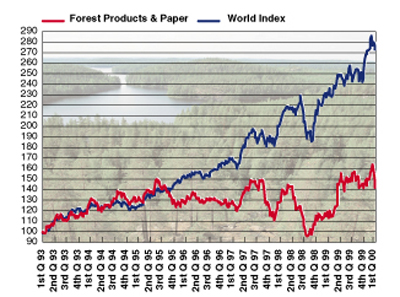

Stock Watch International

Source: Morgan Stanley Capital Investment

|