|

Among the host of new products that have landed on the coating market in the last 12 months, the film press coater is certainly attracting its fair share of attention

By Roger Grant

Film press coater steal the show

The final year of the 20th century was appropriately packed with signs of possible coating trends in the century to come. These signs came in the form of broken production records, company consolidation, widening global reach and technical developments.

The 1998 blockbuster merger of Stora and Enso was followed by the transatlantic link-up between UPM-Kymmene and Champion International, which is to trade under the latter's name. In terms of worldwide coated paper capacity, the new Champion International is about third equal with Oji Paper in the rankings behind Stora Enso and Sappi. Geographically, the two merging companies complement each other nicely with a good global spread.

A relatively new company name in coated papers is Lecta, which is the holding company of CVC's fine paper interests. The group recently acquired Torraspapel, making it the third largest coated woodfree producer in Europe with a capacity of 1.2 million tons/yr.

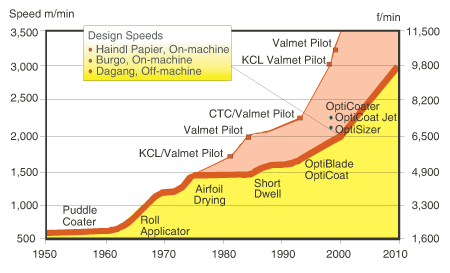

Figure 1 - Progression of commercial and pilot plant coater speeds

On the supplier side, Valmet is claiming three new world records since PPI's last review (PPI May 1999, p.18). The supplier has recorded the progression of coater speeds in Figure 1. First, Valmet broke two 24-hr speed records. One record was achieved on-machine by Champion International's Rauma PM 4 at 1,712 m/min. The machine produces lightweight coated paper (LWC) using OptiBlades. The second record was broken on an off-machine coater at Metsä-Serla's Kirkniemi mill at 1,700 m/min. Coater #3 produces double coated fine papers using OptiCoat Jet coaters. The third record is for the widest off-machine coater, now in place at Asia Pulp & Paper's Gold East Paper Mill in Dagang, China. With a 9.77 m web width, the coater produces double coated fine papers using OptiCoat Jet coaters. The coater's capacity of 600,000 tons/yr and design speed of 2,000 m/min also make it the largest in the world.

Small but speedy

On a smaller scale, North America's fastest pilot plant coater was inaugurated at the brand new Centre International de Couchage (CIC) at Trois Rivières in January 2000 (Figure 2). Heralded in last year's review, this joint venture between GL&V, JM Huber and Mintech has a versatile OptiCoater with a web width of 762 mm and a design speed of 2,500 m/min. Subsequent calendering can either be carried out using an in-line two-nip OptiSoft unit or an 11-nip supercalender. The pilot plant facilities are open to the industry. In Europe, Dow's pilot coater set a new world speed record at 3,259 m/min.

Emerging web sites for e-commerce were also highly visible during the year, not least because of the altitudes to which their shares soared. Trading coated papers is becoming possible in ways that should improve both knowledge of availability and also cut selling costs. Asia Pulp & Paper took an equity stake in PaperExchange.com and PaperLoop is developing its own site called paperloop.com.

Single station two sides

BTG's new Mirroblade, which was described in last year's review, is unique in its ability to blade coat paper on both sides simultaneously. Further experience indicates a design coating range of 3-20 g/m‰/side on base papers of 60-400 g/m‰. The ability to run the paper web either upward or downward through the coater increases machine layout options. The second Mirrorblade installation will be at the Ermolli Group’s Cartificio Monte Rosa mill at Crevacuore, Italy, where it will replace a Billblade HSM on PM 1. Both sides of the 60-190 g/m2 base paper will be coatedsimultaenously with 10-17 g/m2 of coating on each side. Startup is scheduled for August.

The new CIC pilot plant at Trois Rivéres has North America’s fastest coater

BTG has since developed a new actuator for its ABC (Automatic Blade Control) technology. It is based on a double-acting metal diaphragm and can be retrofitted to most of the existing blade beams on the market. As a result, the need to install a new beam is eliminated.

At the start of the 21st century, the film press coater is hogging the limelight in the coating world. This coater is increasingly attracting attention for the following reasons:

- less stress is placed on the light LWC web, enabling the kraft pulp

- content to be reduced from 40-50% to about 20%

- the ability to coat both sides at a single station

- relative simplicity

- complementary developments in online calendering.

Careful coating color formulation and system optimization are helping to overcome the misting and orange peel pattern problems experienced above 1,500 m/min and 10 g/m‰. Film coated LWC papers have a PPS (10S) roughness in the range of 1.3-2.0 µm. This makes the configuration suitable for offset LWC grades (in the 1.1-1.6 µm range), but not yet for rotogravure grades (in the 0.8-1.2 µm range). Voith Sulzer sees this approach as suitable for rebuilding older newsprint or other uncoated mechanical paper machines.

The versatility of the film press coater is being demonstrated at Goricane Paper in Slovenia, where the mill replaced a Billblade Coater with a Voith Sulzer SpeedFlow (add country). The coater produces two side coated woodfrees, coated front (CF) carbonless and silicone release base papers at up to 600 m/min. Ink jet paper is also a future possibility. High coating quality is assisted by the following features:

- color application to each roll by non-contacting MultiJet nozzles, with pre-metering by smooth and profiled rods (depending on grade)

- mechanical and thermal decoupling of this color applicator from its supports

- using the latest composite materials (eg carbon fiber reinforced plastic)

- separate measurement of coat weight on each side

- good color preparation system design.

Top to bottom sheet run was selected at Goricane rather than the other way around, despite the extra space requirement. The decision to use the Air Turn air bar for draw control has proved justified, although this is typically used in only a small proportion of Air Turn installations. When only one side is coated, it is always the top side. The supplier's experience of two side coating on fourdrinier machines indicates an extra 3 g/m‰ of coating is required on the wire side to reduce two-sidedness adequately. Coating weight spread, measured as 2-sigma, is about 0.34 g/m‰ at 8 g/m‰ coat weight for one side coating, and 0.56 g/m‰ for two side coating. Coated paper roughness is greater than that produced by blade coaters, but this is rectified by subsequent calendering.

Both of the new 2,000 m/min PMs at Burgo and Haindl will produce LWC on Valmet's film press coater, the OptiSizer. Elsewhere, low grammages are being coated at very high PM speeds by two OptiSizer units in tandem. First one side is coated and dried before the second side is treated in a similar way. OptiSizers achieve a low color feed rate, typically 20 l/min/m, by using a pressurized closed color feeding chamber that also reduces foaming and skipping. Color screening by Valmet-Raisio's new OptiDozer also benefits from the low flow. According to the supplier, the OptiSizer is the only coating station where color feed is determined by color consumption and this translates into color loss reductions.

Back on board

Board coating has historically been the poor relation of paper coating in process development work. With the speed limitation of air knives becoming increasingly restrictive at about 500 m/min, board machines are starting to benefit from applications developed for paper.

Valmet has applied a new concept for the rebuild of PM 7 at Klabin's Monte Alegre board mill, which was due to restart in April. The main constraints were space limitations and a requirement for good base board coverage. The mill opted to use a SymSizer for precoating and backside surface treatment. Top side coating is carried out with an OptiCoat Duo blade coater, which provides a long dwell between the individual jet applicator roll and final metering backing roll. The OptiCoat can be bypassed when only sizing is required. The design speed is 800 m/min with a width of 6.3 m.

As a part of Valmet's corporate restructuring, the sizing side of the business is being transferred in mid-2000 from the Jyväskylä (Rautpohja) unit. The move will bring all sizing and coating activities together at Järvenpää.

Pigments and pigs

By mid-1999, consolidation among kaolin suppliers had put about 40% of the market in the hands of Imerys (see below), followed by Engelhard and Huber (18-20% each), Thiele (8%), Kadam (7%) and other smaller European players (about 7%). In titanium dioxide, consolidation had already gone far enough for the liking of some regulatory authorities. This can be seen in ICI's failure to sell its operations to DuPont, and then to NL Industries, which now owns Kronos. The company ended up creating a joint venture with Huntsman.

Imerys is the new name of the merged ECC International, Dry Branch Kaolin, Rio Capim Caulim and Georgia Marble under the ownership of Imetal. The link-up makes Imerys the only white pigment supplier with deposits in the UK, middle Georgia and Brazil. It also has carbonate facilities on all the continents, including on-site plants in China. Imerys sees the future of printing papers (including newsprint) hanging on the importance of the visual image. As a result, the company is putting considerable research into understanding the fundamentals of pigments, fibers and additives with a view to permitting faster printing of higher quality. In particular, this means enhancing light scattering by maximizing the proportion of particles at the optimum physical size level. Unlike conventional approaches to increasing pigment brightness, the process either maintains the opacity level or increases it.

The success of color ink jet printing has resulted partly from the properties of silica-based pigments, especially rapid ink absorption and brightness. It was only a matter of time before the growing digital printing market attracted other pigments. Last year's review covered Engelhard's new Digitex - a structured kaolin - which has since been joined by Imerys's kaolin-based product, AstraJet. In addition, Specialty Minerals now also produces calcium carbonate-based Jet Coat 30. This pigment is said to allow a lower coat weight, relative to silica, and give better sheet penetration.

Raisio Chemicals and Rhodia have also teamed up to produce coating latices. The move is designed to make the companies' products more widely available.

On the lubricants side, Omnova Solutions has developed a new organic product called Sequaflow. The lubricant can withstand temperatures exceeding 205°C and provides release without reducing the coated paper's coefficient of friction. It was developed for a mill that wanted to soft calender at high temperatures and pressures. Omnova Solutions was formed after GenCorp decided to spin off its performance chemicals unit and merge it with Sequa Corp.

In the past year, Cellier's development efforts have resulted in the launch of four new products for color preparation and supply:

- Filtercel ACS (Active Cleaning System) improves on the company's standard Filtercel self-cleaning filter mainly by providing continuous operation for one or more weeks. The new system also continuously returns contaminants (eg air, fibers, sand) to the coater color supply tank via a screen. Besides improved screening efficiency, the ACS reduces color loss by over 90% and wash water consumption by over 50%

- Aircel removes air bubbles with a diameter greater than 100 µm from the coating supplied to the coating station

- Dosrac is a piston-based system for measuring and sending precise quantities of color additives to the makedown tank

- the Pigging System consists of a pipe containing one or two plastic pigs, which resemble domestic cotton reels. Each pig fills the pipe's cross-section and drives liquid additives along the pipe to the makedown tank, while also separating individual additives. These additives may be measured and supplied by individual Dosracs. The pigs are driven by compressed air, but have a magnetic core for positioning which also shows their location in the pipe. The advantages include fewer and cleaner pipe runs. Cellier has been using this system in the lubricants industry for some time, but now several European paper mills have taken up the idea.

The viscosity range of ACA Systems and Papertech's ACAV A2 Viscometer models has been further increased in the last 12 months. With an upper limit of 1.5 x 106 s-1 (but up to 10 x 106 s-1 with a slit, if required), the lower limit has dropped to 100 s-1. The new range allows coater color optimization at low, high and ultra high shear rates using a single instrument.

The suppliers foresee ever faster coating speeds, lower coat weights and higher color solids, taking viscosity control increasingly beyond the realm of conventional rotational viscometers. In addition, film press coating has different rheological requirements relative to traditional blade coating.

Control of high shear viscosity (and water retention) are important both when metering the color onto the film press transfer rolls and again at the nip split. For example, a moderately high viscosity appears to inhibit misting and the orange peel effect at the nip. A compromise must be reached with the low viscosity favored for runnability and the rheological complications that can arise as the color solids content is increased.

Dr Roger Grant is editor of the Windows-based encyclopedia, Paper Help. He can be contacted in the UK by fax on +44 1580 241 950 Among the host of new products that have landed on the coating market in the last 12 months, the film press coater is certainly attracting its fair share of attention

Annual Coating Survey

PPI’s team of national editors have summarized the latest coating news from a selection of countries around the globe.

ALGERIA

Algeria sees future growth in coated papers

Algeria continues to meet its coated paper and board requirements through imports. The country's output is mainly based on white papers, but the merchants and importers of coated grades play a large role in the domestic market.

Consumption of paper and board is set to grow considerably, particularly for coated papers. Strong demand is expected from the country's administration and education authorities.

Domestic output of coated board mainly comes from the El Harrach board machine. Another private company is operating a coating machine in the industrial area of Tlemcen. Apart from that, there are no plans to install further coating equipment at present.

Omar Chabane

| Coated Paper and Board Production and Trade in Selected Countries for 1999 |

| COUNTRY |

TOTAL COATED PAPER |

TOTAL COATED BOARD |

TOTAL COATED P&B |

| |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

| ALGERIA |

| Production |

1 |

1 |

– |

1 |

1 |

– |

2 |

2 |

– |

| Imports |

15 |

8 |

–47% |

20 |

9 |

–55% |

35 |

17 |

–51% |

| Exports |

0 |

0 |

– |

0 |

0 |

– |

0 |

0 |

– |

| Consumption |

16 |

9 |

–44% |

21 |

10 |

–52% |

37 |

19 |

–49% |

| AUSTRIA |

| Production |

1,138 |

1,213 |

7% |

387 |

418 |

8% |

1,525 |

1,631 |

7% |

| Imports |

266 |

264 |

–1% |

32 |

40 |

25% |

298 |

304 |

2% |

| Exports |

1,043 |

1,141 |

9% |

301 |

348 |

16% |

1,344 |

1,489 |

11% |

| Consumption |

361 |

336 |

–7% |

118 |

110 |

–7% |

479 |

446 |

–7% |

| BULGARIA |

| Production |

0 |

0 |

– |

14 |

12 |

–14% |

14 |

12 |

–14% |

| Imports |

9 |

7 |

–22% |

4 |

3 |

–25% |

13 |

10 |

–23% |

| Exports |

0 |

0 |

– |

3 |

3 |

– |

3 |

3 |

– |

| Consumption |

9 |

7 |

–22% |

15 |

12 |

–20% |

24 |

19 |

–21% |

| CHILE |

| Production |

5 |

5 |

– |

37 |

110 |

197% |

42 |

115 |

174% |

| Imports |

44 |

43 |

–2% |

10 |

0 |

–100% |

54 |

43 |

–20% |

| Exports |

0 |

0 |

– |

26 |

88 |

238% |

26 |

88 |

238% |

| Consumption |

49 |

48 |

–2% |

21 |

22 |

5% |

70 |

70 |

– |

| CHINA |

| Production |

240 |

440 |

83% |

1,040 |

1,500 |

44% |

1,280 |

1,940 |

52% |

| Imports |

1,000 |

1,078 |

8% |

542 |

964 |

78% |

1,542 |

2,042 |

32% |

| Exports |

52 |

15 |

–71% |

23 |

1 |

–96% |

75 |

16 |

–79% |

| Consumption |

1,188 |

1,503 |

27% |

1,559 |

2,463 |

58% |

2,747 |

3,966 |

44% |

| CROATIA |

| Production |

1 |

1 |

– |

– |

– |

– |

1 |

1 |

– |

| Imports |

30 |

33 |

10% |

18 |

18 |

– |

48 |

51 |

6% |

| Exports |

1 |

1 |

– |

– |

– |

– |

1 |

1 |

– |

| Consumption |

30 |

33 |

10% |

18 |

18 |

– |

48 |

51 |

6% |

| CZECH REP. |

| Production |

12 |

13 |

8% |

22 |

18 |

–18% |

34 |

31 |

–9% |

| Imports |

125 |

136 |

9% |

77 |

47 |

–39% |

202 |

183 |

–9% |

| Exports |

18 |

18 |

– |

5 |

6 |

20% |

23 |

24 |

4% |

| Consumption |

119 |

132 |

11% |

94 |

58 |

–38% |

213 |

190 |

–11% |

| FINLAND |

| Production |

4,358 |

4,411 |

1% |

1,425 |

1,442 |

1% |

5,783 |

5,853 |

1% |

| Imports |

22 |

23 |

5% |

23 |

19 |

–17% |

45 |

42 |

–7% |

| Exports |

4,126 |

4,195 |

2% |

1,277 |

1,335 |

5% |

5,403 |

5,530 |

2% |

| Consumption |

254 |

239 |

–6% |

171 |

126 |

–26% |

425 |

365 |

–14% |

| FRANCE |

| Production |

1,611 |

1,675 |

4% |

238 |

241 |

1% |

1,849 |

1,916 |

4% |

| Imports |

1,820 |

1,964 |

8% |

418 |

424 |

1% |

2,238 |

2,388 |

7% |

| Exports |

1,164 |

1,224 |

5% |

135 |

146 |

8% |

1,299 |

1,370 |

5% |

| Consumption |

2,266 |

2,416 |

7% |

522 |

524 |

0.4% |

2,788 |

2,940 |

5% |

| GERMANY |

| Production |

3,710 |

3,911 |

5% |

1,064 |

1,145 |

8% |

4,774 |

5,056 |

6% |

| INDIA |

|

|

|

|

|

|

|

|

|

| Production |

150 |

205 |

<37% |

400 |

555 |

39% |

550 |

760 |

38% |

| Imports |

15 |

10 |

–33% |

– |

– |

– |

15 |

10 |

–33% |

| Exports |

35 |

40 |

14% |

20 |

45 |

125% |

55 |

85 |

55% |

| Consumption |

130 |

175 |

35% |

380 |

510 |

34% |

510 |

685 |

34% |

| INDONESIA |

| Production |

450 |

450 |

– |

900 |

900 |

– |

1,350 |

1,350 |

– |

| Imports |

– |

– |

– |

– |

– |

– |

– |

– |

– |

| Exports |

400 |

400 |

– |

500 |

500 |

– |

900 |

900 |

– |

| Consumption |

30 |

50 |

67% |

200 |

350 |

75% |

230 |

400 |

74% |

BRAZIL

Coated imports slashed with new machine startups

Brazilian imports of coated woodfrees dropped by 50% last year to a total of just 65,000 tons. The main reason for the fall was the startup of two new coating machines for woodfree papers by VCP and Ripasa.

In 1998, 50% of Brazil's coated woodfree consumption came from imports, but this figure fell to just 25% last year. VCP's chief executive, Raul Calfat, said that an estimated 270,000 tons of coated woodfrees were consumed in Brazil last year. Even though the economy grew by less than 1%, consumption showed an increase of 3.5% over the previous year's figure.

VCP is now by far the largest producer of coated woodfrees in Brazil, with a capacity of 175,000 tons/yr. The company used 110,000 tons of its capacity last year and no further investments are expected in this area. Calfat expects to see substantial growth in coated paper consumption in 2000, with the Brazilian economy forecast to expand by at least 3%.

Calfat adds that imports of some types of coated grades will continue - notably, triple coated paper, which is not produced in Brazil. Very little coated woodfree paper is now exported, but any paper that does leave Brazil is usually shipped to other countries in the region.

Inpacel churned out some 55,000 tons of woodcontaining paper at its mill in Parana state last year. Of this figure, 40% was exported. Inpacel's operations are gradually being merged with those of the Champion group, which bought the Brazilian company two years ago. Champion has consistently exported 50% of the printing/writing papers produced at its Sao Paulo state mill. The goal is to export the same percentage of Inpacel's output. But demand for coated woodcontaining papers, particularly for magazine inserts in newspapers, has grown sharply in Brazil in recent years.

Patrick Knight

|

Coated Paper and Board Production and Trade in Selected Countries for 1999

|

| COUNTRY |

TOTAL COATED PAPER |

TOTAL COATED P&B |

TOTAL COATED BOARD |

| |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

| ISRAEL |

| Production |

6 |

7 |

17% |

– |

– |

– |

6 |

7 |

17% |

| Exports |

– |

– |

– |

– |

– |

– |

– |

– |

– |

| Consumption |

87 |

102 |

17% |

40 |

40 |

– |

127 |

142 |

12% |

| ITALY |

| Production |

1,916 |

2,021 |

5% |

767 |

837 |

9% |

2,683 |

2,858 |

7% |

| Imports |

863 |

907 |

5% |

290 |

333 |

15% |

1,153 |

1,240 |

8% |

| Exports |

825 |

877 |

6% |

341 |

371 |

9% |

1,166 |

1,248 |

7% |

| Consumption |

1,955 |

2,050 |

5% |

716 |

799 |

12% |

2,671 |

2,849 |

7% |

| JAPAN |

| Production |

5,749 |

6,230 |

8% |

1,634 |

1,642 |

0.5% |

7,383 |

7,872 |

7% |

| Imports |

165 |

110 |

–33% |

65 |

79 |

22% |

230 |

189 |

–18% |

| Exports |

407 |

538 |

32% |

131 |

134 |

2% |

538 |

672 |

25% |

| Consumption |

5,507 |

5,802 |

5% |

1,568 |

1,587 |

1% |

7,075 |

7,389 |

4% |

| KOREA |

| Production |

1,118 |

1,302 |

16% |

933 |

1,087 |

17% |

2,051 |

2,389 |

16% |

| Imports |

17 |

30 |

76% |

2 |

2 |

– |

19 |

32 |

68% |

| Exports |

755 |

823 |

9% |

619 |

686 |

11% |

1,374 |

1,509 |

10% |

| Consumption |

386 |

516 |

34% |

339 |

392 |

16% |

725 |

908 |

25% |

| LITHUANIA |

| Imports |

13 |

14 |

8% |

9 |

6 |

–33% |

22 |

20 |

–9% |

| Exports |

1 |

0 |

–100% |

3 |

1 |

–67% |

4 |

1 |

–75% |

| Consumption |

12 |

13 |

8% |

6 |

5 |

–17% |

18 |

18 |

– |

| MEXICO |

| Production |

100 |

124 |

24% |

307 |

328 |

7% |

407 |

452 |

11% |

| Imports |

94 |

123 |

31% |

43 |

55 |

28% |

137 |

178 |

30% |

| Exports |

0 |

0 |

– |

0 |

0 |

– |

0 |

0 |

– |

| Consumption |

194 |

247 |

27% |

350 |

383 |

9% |

544 |

630 |

16% |

| NETHERLANDS |

| Production |

465 |

485 |

4% |

– |

– |

– |

465 |

485 |

4% |

| Imports |

470 |

478 |

2% |

– |

– |

– |

470 |

478 |

2% |

| Exports |

420 |

429 |

2% |

– |

– |

– |

420 |

429 |

2% |

| Consumption |

515

|

534 |

4% |

– |

– |

– |

515 |

534 |

4% |

| ROMANIA |

| Production |

– |

– |

– |

– |

4 |

100% |

– |

4 |

100% |

| Imports |

16 |

23 |

44% |

18 |

15 |

–17% |

34 |

38 |

12% |

| Exports |

– |

– |

– |

– |

– |

– |

– |

– |

– |

| Consumption |

16 |

23 |

44% |

18 |

19 |

6% |

34 |

42 |

24% |

| RUSSIA |

| Production |

8 |

8 |

– |

27 |

53 |

96% |

35 |

61 |

74% |

| Imports |

30 |

40 |

33% |

19 |

50 |

163% |

49 |

90 |

84% |

| Exports |

0 |

0 |

– |

0 |

5 |

100% |

0 |

5 |

100% |

| Consumption |

38 |

48 |

26% |

46 |

98 |

113% |

84 |

146 |

74% |

| SLOVAKIA |

| Production |

11 |

5 |

–55% |

0 |

0 |

– |

11 |

5 |

–55% |

| Imports |

41 |

45 |

10% |

22 |

23 |

5% |

63 |

68 |

8% |

| Exports |

3 |

1 |

–67% |

0 |

0 |

– |

3 |

1 |

–67% |

| Consumption |

48 |

49 |

2% |

21 |

23 |

10% |

69 |

72 |

4% |

| SLOVENIA |

| Production |

111 |

106 |

–5% |

114 |

130 |

14% |

225 |

236 |

5% |

| Imports |

13 |

14 |

8% |

7 |

7 |

– |

20 |

21 |

5% |

| Exports |

71 |

75 |

6% |

90 |

110 |

22% |

161 |

185 |

15% |

| Consumption |

53 |

45 |

–15% |

31 |

27 |

–13% |

84 |

72

|

–14% |

| SPAIN |

| Production |

457 |

482 |

5% |

442 |

437 |

–1% |

899 |

919 |

2% |

| Imports |

1,216 |

1,269 |

4% |

107 |

104 |

–3% |

1,323 |

1,373 |

4% |

| Exports |

392 |

406 |

4% |

226 |

230 |

2% |

618 |

636 |

3% |

| Consumption |

1,281 |

1,345 |

5% |

323 |

311 |

–4% |

1,604 |

1,656 |

3% |

China

Chinese market gathers strength

Production of paper and board soared in China last year. Paper output climbed 83%, while board production grew 44%. Overall coated consumption also rose 44%.

China saw its fair share of new machine startups in 1999. On the paper side, arguably the most significant startup was Asia Pulp & Paper's (APP) new coater at the Dagang mill. The 600,000 ton/yr Valmet coater came on stream in mid-1999. The machine was installed to coat the output from Dagang's two new giant woodfree PMs.

Shandong Chenming Paper Holdings also started commercial production on a new 100,000-140,000 ton/yr PM at the beginning of last year. The PM produces lightweight coated (LWC) and uncoated woodfree papers. The company has already moved onto its next expansion project. Shandong Chenming will install a new fine paper PM at the mill, with startup planned for 2001.

LWC is also proving a popular grade elsewhere in China. Dongying Xie Fa started up a new 35,000 ton/yr PM at the end of 1999, while Sun Paper is due to launch production on a 100,000 ton/yr machine this month.

China is also making progress in coated board production. In early 1999, Shandong Huazhong Paper started up a new 126,0000 ton/yr coated board PM and the company is already thinking of installing another machine at its Zaozhuang mill. Last year also saw the startup of a new 150,000 ton/yr coated board PM at Zhuhai Hongta Renheng Paper's Zhuhai mill, while a 100,000 ton/yr coated board machine came on stream at the state-owned Victorgo mill.

Eastern Europe

imports dominate in eastern Europe

The coated paper and board scene is far from thriving across eastern Europe. Coated production is yet to take off in Bosnia-Herzegovina and Macedonia, leaving the two markets open for imports. The situation is similar in Yugoslavia, where two of the country's three coating plants are closed.

Nearly all of Romania's coated paper and board consumption was covered by imports last year. Unfortunately, most of the country's coated paper and board machines have been completely shut down or mothballed. Most machines need to be upgraded to produce coated paper and board of sufficient quality. But at present, there are no modernization plans for new coaters in Romania. All is not doom and gloom though, as Petrocart managed to produce 4,000 tons of coated duplex board last year.

SCP upgrades PM 7 in Slovakia

Slovakia's main pulp and paper producer, Severoslovenské Celulózky a Papierne (SCP), is also the country's only producer of coated grades. The company's output of coated paper dropped by 50% in 1999, compared to the previous year.

The main reason behind the production drop was the company's decision to focus on producing high quality offset papers. SCP's coating unit had become less efficient due to the large variety of basis weights produced and relatively small number of orders. The switch to coating base papers will allow the company to become more profitable.

Output of the mill's coating line was also affected by a rebuild carried out on PM 7. The modernization resulted in a capacity increase from 48,000 tons/yr to 100,000 tons/yr of printing/ writing papers. The situation is expected to be similar in the first half of this year, with lower coated production planned at the mill.

Coated paper and board output showed little progress in Croatia last year. The modernization project at the Pan Paper and Board Mill did not go ahead as planned and, due to unfavorable market conditions, the country's oldest paper mill, Rijeka, was also forced to stop production.

In Bulgaria, production and consumption of coated grades showed little change on previous years in 1999. But in some areas, there was a slight drop in both measures. Consumption remains limited due to the country's economic problems and low standard of living.

In Lithuania, the only coated paper producer is the Kaunas mill. Last year, production of coated papers fell by 71% while imports rose 8%. Single coated paper would appear to have the brightest outlook in the country, although there is strong competition from Poland and Scandinavia.

Meanwhile, Slovenia seems to have bucked the overall trend in eastern Europe. In contrast to many of its neighbors, Slovenia's coated paper producers have seen strong order books over the past year, especially for exports. But the strong demand has not translated into higher prices for these products. Despite the steady rise in raw material prices, companies have had to fight hard to increase paper prices.

The Goricane paper mill installed a new online SpeedFlow coater from Voith Sulzer. The company also invested in a new coating kitchen and infrared drying device, while the air recovery system and automation were upgraded. The $7 million investment will allow the company to produce 40,000 tons/yr of coated, ink jet and silicone base papers as well as other printing grades.

Milos Kuzminac, Gheorghe Borhan, Ante Klaric, Stefan Zaprianov, Ceslovas Svetkauskas, Franti¼ek Valcek and Janez Hocevar.

| Coated Paper and Board Production and Trade in Selected Countries for 1999 |

| COUNTRY |

TOTAL COATED PAPER |

TOTAL COATED BOARD |

TOTAL COATED P&B |

| |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

1998 |

1999 |

% Change |

| SWEDEN |

| Production |

1,010 |

1,038 |

3% |

779 |

798 |

2% |

1,789 |

1,836 |

3% |

| Imports |

95 |

101 |

6% |

26 |

27 |

4% |

121 |

128 |

6% |

| Exports |

814 |

843 |

4% |

664 |

744 |

12% |

1,478 |

1,587 |

7% |

| Consumption |

242 |

255 |

5% |

94 |

108 |

15% |

336 |

363 |

8% |

| SWITZERLAND |

| Production |

259 |

326 |

26% |

113 |

118 |

4% |

373 |

444 |

19% |

| Imports |

323 |

334 |

3% |

118 |

115 |

–3% |

441 |

449 |

2% |

| Exports |

223 |

285 |

28% |

74 |

77 |

4% |

297 |

362 |

22% |

| Consumption |

360 |

375 |

4% |

157 |

156 |

–1% |

517 |

530 |

3% |

| TAIWAN |

| Production |

323 |

324 |

0.3% |

611 |

586 |

–4% |

934 |

910 |

–3% |

| Imports |

65 |

95 |

46% |

27 |

41 |

52% |

92 |

136 |

48% |

| Exports |

64 |

77 |

20% |

256 |

207 |

–19% |

320 |

284 |

–11% |

| Consumption |

324 |

359 |

11% |

381 |

420 |

10% |

705 |

779 |

10% |

| UK |

| Production |

740 |

793 |

7% |

270 |

264 |

–2% |

1,010 |

1,057 |

5% |

| Imports |

1,770 |

1,870 |

6% |

580 |

470 |

–19% |

2,350 |

2,340 |

–0.4% |

| Exports |

245 |

252 |

3% |

90 |

86 |

–4% |

335 |

338 |

1% |

| Consumption |

2,266 |

2,411 |

6% |

759 |

647 |

–15% |

3,025 |

3,058 |

1% |

| VIETNAM |

| Production |

2 |

2 |

– |

– |

– |

– |

2 |

2 |

– |

| Imports |

18 |

21 |

17% |

5 |

6 |

20% |

23 |

27 |

17% |

| Exports |

– |

– |

– |

– |

– |

– |

0 |

0 |

– |

| Consumption |

20 |

23 |

15% |

5 |

6 |

20% |

25 |

29 |

16% |

| YUGOSLAVIA/BOSNIA-HERZEGOVINA/MACEDONIA |

| Production |

– |

– |

– |

30 |

28 |

–7% |

30 |

28 |

–7% |

| Imports |

14 |

9 |

–36% |

11 |

8 |

–38% |

25 |

17 |

–32% |

| Exports |

– |

– |

– |

5 |

1 |

–80% |

5 |

1 |

–80% |

| Consumption |

14 |

9 |

–36% |

36 |

35 |

–2.7% |

47 |

45 |

–4% |

Finland

Finnish companies clean up in the USA

Finnish companies have stepped up the pace of global expansion in recent months. Following the collapse of cooperation between UPM-Kymmene and APRIL, the Finnish company turned its sights on the USA and created the new powerhouse - Champion International. The linkup between UPM-Kymmene and Champion had been expected to a certain extent, but Stora Enso stole a march on industry observers when it snapped up Consolidated Papers.

Both new groups are seriously large paper producers. Champion International is the world's second largest fine paper producer, while the Stora Enso/Consolidated combination creates the number three producer in this grade. Champion International has less uncoated fine paper capacity than its rival, but the new company is the largest lightweight coated (LWC) producer. Stora Enso/Consolidated holds the number two position in this grade.

Spending money

Although there are a number of projects underway, investment in coated papers is still running at quite low levels. Metsä-Serla plans to rebuild PM 4 at its Kangas mill and the machine will start producing coated fine paper in 2001. UPM-Kymmene will modernize PM 8 at its Kymi mill, switching from uncoated to coated fine paper production. The modernized machine should be up and running in the fourth quarter of 2001.

Stora Enso is investing Euro 16.5 million ($17.1 million) in PM 4 at the Kabel mill in Germany. The project started in January this year and will be completed in January 2001. Capacity will rise by 12,000 tons/yr.

No major investments in coated magazine paper are under way in Finland at the moment. But new investments could be in the offing when Stora Enso and UPM-Kymmene have had time to digest their recent round of mergers.

Pekka Rinne

GERMANY

Germany aims higher

German output of coated papers topped the 3.9 million ton mark in 1999. This represents a 5% increase on 1998 levels. Production of both coated mechanical and coated woodfree papers grew by 5.4% to reach 2.3 million tons last year. Coated board production jumped 7.6% to over 1.1 million tons.

On the coated paper side, Haindl is building a 400,000 ton/yr lightweight coated (LWC) machine. Startup will take place in July 2000.

Rolf Döhring

INDIA

India picks up pace

Following three years of unsatisfactory performance, the Indian paper industry started to pick up in the last three quarters of 1999. Coated paper and board markets have gained strength and product quality has also improved.

There are some 30 coating machines in India, covering both online and offline units. Several mills are planning to replace their air-knife coaters with blade equipment.

In the past year, Ballarpur Industries has taken over Servall Engineering's coated board unit at Coimbatore. Ballarpur has also entered into a strategic alliance with Hansol of Korea and Japan's Dai-Ei Papers. The Japanese firm sells lightweight and high quality coated papers. Similarly, JK Corp has entered into a marketing agreement for imported paper grades. Sinar Mas India also aims to export 40,000 tons/yr of paper, 80% of which is likely to be coated grades.

On the investment front, Seshasayee installed a 55,000 ton/yr PM with an online coating machine. Startup is due shortly. West Coast Paper Mills is adding a duplex board machine for heavyweight coated board. On top of that, the new coating unit at Gayatri Shakti is likely to come on stream shortly.

Going forward, the Indian coated paper and board sector is expected to grow at a rate of 8-10%, according to recent forecasts.

NJ Rao

INDONESIA

Economic recovery fuels appetite for paper

As the Indonesian economy improves, the domestic market for coated paper and board is also expanding. Demand and shipment levels shot up by 80% in 1999 year-on-year. Indonesia's coated woodfree capacity stands at 530,000 tons/yr, while coated board is at 1.3 million tons/yr. Operating rates are hovering at between 70% and 80%.

Domestic demand was very low in 1998, but exports of coated products have held steady for the last two years. For this reason, the industry has been able to maintain high production levels.

At present, there are no plans to install new capacity in 2000. Current capacity levels are sufficient to cover both the local market as well as exports. Going forward, the coated paper and board market is forecast to show improvement in the next few years. As demand picks up, producers will expand capacity when the market is ready to absorb additional output.

H M Mansur

JAPAN

Japanese figures edges up

The pulp and paper industry is making progress on the back of Japan's slow economic recovery. Coated papers (mainly lightweight and pigmented grades) are performing particularly well, with nearly double-digit growth in production and shipments last year. The main reason behind the strong growth is the rise in demand for commercial printing, including leaflets and manuals for personal computers, mobile telephones, etc. The market for these grades is very tight. Production capacity has not increased recently and there are no capacity expansions planned for the near future.

Domestic demand for coated paper dropped 3.5% in 1998, but levels increased significantly last year. As volumes are already at a high level and price increases are anticipated, the Japan Paper Association (JPA) forecasts that domestic demand will grow 3.8% in 2000 on 1999 levels. Some industry observers believe that this forecast is conservative, taking into account the predicted economic recovery, limited capacity increases and a potential boost in demand from events such as the Sydney Olympic games, the Okinawa Summit and general elections.

The JPA forecasts that overall there will be little change in coated board demand growth on 1999 levels though. With regard to trade, paper exports climbed by 538,000 tons in 1999 following the economic recovery in southeast Asia and increased purchasing by Chinese customers. On the other hand, imports dropped by 110,000 tons due to low prices in the domestic market and increased Japanese supplies.

Satori Mitsui

KOREA

Domestic producers delve into higher quality products

Production of coated printing/writing grades is growing rapidly in Korea. Printing/writing paper companies are switching to produce higher quality coated grades, leaving uncoated grades to be covered by imports.

This trend has been taking place throughout the past decade, but has recently gathered pace. The main reason is that the basic commodity grades produced in Korea are no longer competitive against Indonesian and Chinese imports. This year, imports of these grades are expected to grow substantially. Hansol and Moorim now import and distribute copy papers from Indonesia and China. The country is also receiving copy paper from the new Chinese mills recently started up by Indonesian companies.

In 1999, imports of copy papers reached 61,280 tons on a customs clearance basis. Of this figure, 48,862 tons were imported from Indonesia, while 7,049 tons came from China. But this year, China is expected to the grab the lion's share of the imports.

Adding value

Another trend that is being witnessed among Korea producers is expansion into high value specialty grades. Hankuk Paper had previously delayed its PM 3 expansion at the Onsan mill due to the Asian financial crisis. But in January of this year the company announced that it would be proceeding with the $60 million investment and startup is penciled in for June 2001. PM 3 will produce heavyweight coated art papers and other specialty grades such as shopping bags, file, drawing, card and food packaging papers. The PM's capacity will be 80,000 tons/yr. Of the 261,400 tons of woodfree grades that Hankuk produced in 1999, 57% (or 143,200 tons) was double coated art papers.

Shinmoorim Paper started up its new PM 3 in May 1999 with a capacity of 185,000 tons/yr. This machine is designed to produce all double coated art papers. Shinmoorim churned out a total of 264,428 tons of printing grades in 1999, 85% of which were coated grades.

Daehan Pulp started up PM 3 at its Chungwon mill in January 1999. This PM produces 165,000 tons/yr of coated duplex board.

C B Lee

MEXICO

Mexico reports solid progress

The demand for coated paper and board has maintained solid and steady growth. Coated paper production showed a 24% increase, mostly due to higher capacity utilization. Coated board production reached 328,000 tons, up 7% on the previous year. The new coated board capacity at Productora de Papel (Propasa) in Monterrey started up in the last quarter, but had negligible impact on the total year volume.

Demand for coated paper grades was good as the overall economy showed a strong performance. Despite the additional production, imports were 31% higher than in 1998 at 123,000 tons. This combination caused apparent consumption to grow by 27%. Coated board showed more modest growth, but total apparent consumption was still 9% higher than in 1998.

In 2000, the impact of Propasa's operation will be reflected. Smurfit is also implementing rebuild projects for its coated board units.

Xavier Llamas

Russia

Coated producers do well as crisis recedes

Coated paper and board markets benefited particularly well from the recovery of the Russian economy following the financial collapse of August/September 1998. The rapid devaluation of the rouble drove a sharp increase in demand for Russian-made products. This in turn drove demand higher for both domestic and imported coated boards.

In the paper sector, advertising expenditure has now recovered to pre-crisis levels, but advertisers have become more conscious of the need to get value for money. This has benefited more targeted media such as direct mail and brochures using coated paper, and certainly to a greater extent than mass media such as newspapers. However, modern printing capacity for coated paper products is still very limited in Russia, especially for longer run products that would use coated mechanical papers.

There is still virtually no coated paper capacity in Russia and the two existing expansion schemes at Kamsky and Goznak Krasnokamsk are making little progress. This is partly because both mills are still state-owned and only Kamsky is likely to be privatized in the near future.

Coated board capacity should expand significantly at two mills during the 2000-2003 period. Ilim Pulp's St Petersburg Board and Printing Mill is raising WLC (white-lined chipboard) capacity to 100,000 tons/yr and Stupex is hoping to have the capacity to produce 60,000 tons/yr of coated WLC. Both mills have integrated folding carton production but will have significant quantities of board for sale to the market. The St Petersburg mill expects to become a major exporter of coated board.

Margaret Leach

SPAIN

Paper leaps while board dips

Consumption of coated papers rose by 5% in Spain last year, according to the latest estimates. The extra demand was covered by a rise in domestic output of 5.4% along with a 3.6% increase in imports. Exports of coated papers also edged up 3.6% last year.

There are no coated mechanical paper machines operating in Spain at present, but imports are considerable. Imports of coated mechanical grades soared 6.5% last year on the back of a similar increase in consumption.

In contrast, Spanish producers saw a slight decrease in coated board consumption. But suppliers managed to maintain production levels by boosting export sales.

Andrés Baena

Sweden

Sweden sees fine future for coated grades

The short term outlook for coated paper and board in Sweden appears to be rosy and expectations for coated printing paper are particularly high. Demand for woodcontaining grades is growing on the back of steadily rising prices for coated woodfree grades. Equally, demand for virgin fiber-based paperboard is also on the upswing, with some companies reporting that order intake has expanded faster than deliveries. As a result, order books are well filled for most companies.

Fine paper demand has also risen, but paper producers have had trouble keeping pace with rapidly rising market pulp prices. Producers are hoping to raise paper prices again this year (especially the non-integrated companies).

Since the creation of Modo Paper through the merger of SCA and MoDo's fine paper operations, the new company has shown strong signs of moving into coated grades.

Modo Paper will invest SEK 2 billion ($229 million) in new coating operations and an upgrade of PM 8 at the Husum mill in Sweden. The investment includes a 300,000 ton/yr off-machine coater for production of matt and glazed grades.

As part of the merger, the pilot coating plant operated by the former MoDo Paper was moved to Iggesund where it is now run as the Holmen Center of Excellence Surface Treatment. The rebuilt pilot coater is 0.53 m wide, runs at 800 m/min and coats base papers in the 50-400 g/m2 range. The machine is equipped with a blade coater with roll application and an ABC coater head. It also has a film press size press, electric infrared and air float dryers as well as thermo-soft/soft-soft calenders and a brush calender.

David Wold

UK

Grades get another boost

The UK economy expanded faster than was widely expected in 1999, with GDP growth reaching 2.0%. Coated paper and board consumption showed a similar rise. According to estimates, GDP is expected to grow by 3.2% in 2000 and 2.7% in 2001.

On the paper side, Sappi has ceased cast coated production at its Blackburn mill and the Astralux cast coated brand has been sold to Italy's Favini Group. The mill will concentrate on coated woodfrees in future.

As a part of its restructuring program, Arjo Wiggins Appleton (AWA) closed its carbonless and thermal paper Idem mill at Cardiff. The group subsequently demerged its merchanting arm as a new company called Antalis. The carbonless and thermal paper division may also be demerged.

Roger Grant

VIETNAM

Vietnam sees rapid rises

Demand for coated paper and board is growing quickly in the printing sector for book covers, magazines and calendars. On top of that, rapid progress in the pharmaceutical, cosmetic and cigarette industries is also helping to boost consumption.

Demand levels grew by 16% last year, while consumption is estimated to have reached 28,500 tons.

Coated paper imports also showed a sharp increase in 1999. Production capacity at the country's only coated paper company, Dong Nai Paper, is very limited. Viet Tri's 10,000 ton/yr board line may be started in the second half of 2001, but the expansion will only add 4,000-5,000 tons in that year.

|