|

Modo stalls on stock flotation

Holmen and SCA have pushed back plans to reduce their 50/50 shareholding in Modo Paper to 15% each. SCA planned to sell its 35% slice of Modo Paper through an initial public offering (IPO) in April, while Holmen aimed to distribute its stake among the company's shareholders.

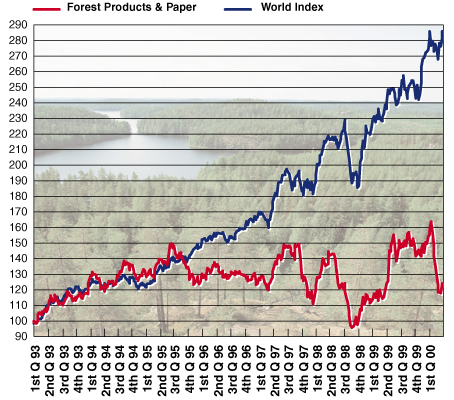

But the current low valuation of forest products industry shares on the global stock markets has forced the company to revise their plans. The two parties have decided to postpone the flotation "until market conditions are more suitable".

The move has re-ignited rumors that Modo Paper is open to offers from industrial buyers. SCA's senior vice president of corporate communications, Sten Lindholm, said that the company has received considerable interest from industrial buyers. "If we get a very good offer, we have to consider it, but the main direction is still a flotation," Lindholm said.

For an industrial buyer to walk off with a controlling stake in Modo Paper, both Holmen and SCA would each have to agree to sell their 35% stakes. According to Per Ericson, Holmen's president and chief executive officer, "[The company] is not interested in this kind of offer." He added that Holmen "is going to do what we originally planned".

Analysts do not believe that an industrial buyer is waiting in the wings, though. According to one industry observer, Holmen and SCA would not have made the announcement if they already had a buyer lined up. Holmen and SCA would be unlikely to get a good price for Modo Paper, given the current value of stocks in the forest products industry, the analyst added.

|

BELGIUM

|

|

Sappi splashes out in Belgium

Beloit is to install a new headbox and profile scanner on the machine. The rebuild is aimed at improving product quality on the 265,000 ton/yr coated mechanical paper machine. The project cost will total Euro 3.6 million ($3.5 million).

Sappi also plans to invest in Lanaken's other coated mechanical line to enable PM 7 to produce coated woodfree paper. The first phase of the project is due to begin before the end of the year.

PM 7 will be able to produce either coated mechanical or coated woodfree paper after the rebuild, depending on market demand. The project cost is set at Euro 16 million.

|

FINLAND

|

|

Sofidel bounces back

Metsä-Serla has denied reports that it is interested in buying Modo Paper. The Finnish producer said that Modo Paper would not fit in with its strategy to focus on coated paper and packaging production.

Metsä-Serla's executive vice president and chief financial officer, Veli-Matti Mynttinen, explained that Modo Paper has "too much uncoated paper in its product range". Mynttinen confirmed that Metsä-Serla has received offers from investment bankers active in the paper sector. The financial institutions offered to finance a buy-out of Modo Paper by Metsä-Serla.

Myllykoski meets PM's pulp demand

Myllykoski plans to raise groundwood pulp capacity at its Anjalankoski paper mill. The Finnish producer is to spend $20 million on the mill's pressurized groundwood plant to increase its output from 400 tons/day to 500 tons/day.

The investment is aimed at debottlenecking the pulp line so that the plant can satisfy Anjalankoski's fiber needs. The extra pulp output will be used internally to produce supercalendered paper at the mill.

Ahlstrom sees ownership change

Andritz of Austria has signed an agreement to acquire 50% of the shares in Ahlstrom Machinery.

The new firm, Andritz-Ahlstrom, will be an independent company owned on a 50/50 basis by Andritz and A Ahlstrom. Both owners may exercise options in future to become full owners of the machinery supplier.

|

|

FRANCE

|

|

Lucart invests in tissue

Lucart France is splashing out on a new tissue machine for its mill in Trovilliers, France.

Valmet will supply the 30,000 ton/yr crescent former machine which is due to begin commercial production in August 2001. The 2.7 m wide PM will have a design speed of 2,100 m/min. The order is valued at Euro 8 million ($8 million).

The new machine will be the mill's first tissue PM and will supply a converting plant which Lucart France recently started up at the site. Lucart France is owned by Cartiera Lucchese of Italy.

Rossmann/Bauernfeind form Roba

The Rossmann group of France has hooked up with Austria's Roman Bauernfeind to form a new company called Roba. The venture will be a vehicle for investment and expansion within the European, African and Asian corrugating materials and corrugated board markets.

Expansion in the UK is at the top of Roba's list of priorities. The company is on the lookout for suitable acquisitions in the UK packaging markets.

Rossmann and Bauernfeind will jointly own the new company, but they will remain independent, family-owned businesses.

|

|

GERMANY

|

|

Omega tries out tissue PM

Omega Papier Wernshausen has started trial runs on a new tissue machine at its mill in Wernshausen, Germany.

The 36,000 ton/yr Beloit machine has a design speed of 1,600 m/min and is 3.45 m wide. Output from the new machine will be integrated with on-site converting facilities, producing toilet paper and hand towels.

|

|

FINLAND

|

|

UPM-Kymmene dismisses IP

UPM-Kymmene has brushed off reports that the company's plans to merge with Champion are under threat from a counter-bid by International Paper (IP).

UPM-Kymmene's senior vice president for investor relations and administration, Kari Toikka, dismissed the reports as market rumors, saying "the merger has been agreed by both boards". He added, "UPM-Kymmene is confident that it will be accomplished."

IP's media relations officer, Jack Cox, said that he could not comment on the possibility of IP bidding for Champion. Cox stressed that the report came from just one analyst's comments.

But according to Deutsche Banc Alex Brown analyst, Mark Wilde, who made the comments, there is a 40-50% chance that Champion's shareholders will reject UPM-Kymmene's offer. The US company's shareholders are due to vote on the offer this month.

Champion's share price slid from $56/share to $50/share since the merger was announced in the middle of February. Wilde said, "A lot of people think that Champion is worth a lot more than $50 a share."

But UPM-Kymmene's Kari Toikka claims that the dip in Champion's share price is part of a worldwide depression in forest industry stock valuations.

Stock problems: Another troublesome aspect of the deal is the fact that US-based equity funds cannot hold Finnish-listed stock. UPM-Kymmene aims to list the new company, Champion International, on the Helsinki stock exchange.

Under the deal, Champion's shareholders will receive stock in UPM-Kymmene. This means that equity fund managers must sell their Champion shares before the merger takes place. But Toikka believes the Finnish listing of the new company should not cause difficulties. UPM-Kymmene's advisors estimate that only a minority of Champion shares are held in equity funds in the USA.

Analysts also believe the deal's success could be hindered as it is an all-stock offer. Forest industry shares currently have low valuations on the global stock market. Some analysts feel that a part cash/part stock offer would have a higher chance of success.

|

|

ITALY

|

|

Imbalpaper orders new machine

Imbalpaper has ordered a new tissue plant for its mill in Lucca, Italy. Recard will supply a 125 ton/day tissue PM, as well as three stock preparation lines, a slitter/rewinder and all auxiliary equipment for the plant.

The PM will have a maximum working speed of 1,800 m/min and will be 2.75 m wide. Recard is to deliver the equipment in January 2001, with startup scheduled to follow in April.

Fire hits Reno de Medici mill

Reno de Medici has been hit by a fire at its mill in Magenta, Italy. The blaze destroyed two warehouses at the site and wiped out the mill's raw material stocks, including some 15,000 tons of wastepaper and pulp. No one was injured during the fire and the mill's machinery remained unscathed.

The lack of raw materials forced the mill to halt production on its two board machines for several days. But Reno de Medici managed to restart the PMs after securing more raw material supplies.

The Magenta mill near Milan has two machines which produce 170,000 tons/yr of white-lined chipboard and coated duplex board.

|

SWEDEN

|

|

SCA streamlines tissue output

SCA has wrapped up the closure of converting operations at its Nättraby mill in Sweden. The company gradually phased out the units during 1999 and the first quarter of this year.

The shutdown was part of SCA's efficiency improvement program. Under the scheme, the company plans to consolidate tissue production at fewer mills, each of which

will have a capacity of at least 100,000 tons/yr.

Nättraby's converting units will be relocated to SCA's mills in Kostheim, Germany, and Lilla Edet in Sweden. Nättraby continues to produce 30,000 tons/yr of tissue on two machines.

SCA first announced plans to close Nättraby three years ago. But the company has no firm timetable to shut down the mill's tissue PMs.

|

LATVIA

|

|

Pulp group launches Latvian project

Metsäliitto and Södra have finally teamed up with Latvian representatives to form the Riga-based project company, Baltic Pulp. Under the agreement, Metsäliitto will take a 34% stake in Baltic Pulp, while Södra and the Republic of Latvia will each subscribe to a 33% share in the company. The company will investigate the feasibility of building a 600,000 ton/yr bleached sulfate pulp mill in Latvia.

A final decision on the construction of the proposed $900 million site is due by 2002 at the latest.

|

SAUDI ARABIA

|

|

Waraq boosts packaging

Waraq is installing a new 120,000 ton/yr packaging paper machine at its mill in Dammam, Saudi Arabia.

PM 2 is part of a large scale expansion program that is aimed at boosting the mill's production of packaging grades to 200,000 tons/yr. The new PM is due to come on stream in mid-2002.

PM 2 will be built next to the mill's existing PM. Both machines will produce fluting, testliner and white top testliner, as well as brown and white top kraftliner and core board. Waraq will sell the PM's output in the Middle East and Asia. The new machine will also produce twin layer board grades from recycled and imported virgin pulp.

|

NORWAY

|

|

Norske Skog seals Södra deal

Norske Skog has signed a letter of intent for the sale of its two pulp mills in Norway to Södra of Sweden. Following the deal, the Norwegian producer will exit the pulp production business, while Södra's pulp output will be boosted by 480,000 tons/yr to reach 2 million tons/yr. Norske Skog said the sale is in line with the group's aim to focus on publication papers.

The two groups are still hammering out the details of the final agreement that will hand over the ownership of the Tofte and Folla pulp mills to Södra. Norske Skog hopes to tie up the deal before the mid-year vacation period.

But the Norwegian supplier is playing its cards close to its chest when it comes to revealing how the group will spend the proceeds from the sale. The company said that the cash would be "reinvested very quickly" after the deal is completed. "We will have to invest the money, otherwise we will have too much," a company source said.

Norske Skog was quick to point out that investment was not the reason behind the sale. Södra came up with an attractive offer for the two sites and the group jumped at the opportunity, according to Norske Skog.

The Tofte mill is situated southwest of Oslo and has a capacity of 380,000 tons/yr of bleached sulfate pulp. Södra said that the site's size and design is comparable with its Mörrum pulp mill. Folla produces up to 100,000 tons/yr of chemi-thermomechanical pulp and is located to the north of Trondheim.

|

UNITED ARAB EMIRATES

|

|

Emirates builds machine house

Emirates Paper Mill (EPM) has started laying the foundations for a new 100 ton/day tissue machine in the United Arab Emirates (UAE).

The company is busy constructing the building that will house the new PM. The Dirham 80 million ($22 million) investment will increase EPM's tissue capacity to 60,000 tons/yr from 20,000 tons/yr.

EPM's parent company, the Sharma group, expects to start up the new crescent former tissue machine in December 2000. Delivery of the Recard machine is penciled in for June.

PM 2 has a design speed of 1,500 m/min. The machine will produce tissue in a basis weight range of 12-40 g/m=.

Amir owner to fight mill sale

The owner of Amir Paper and Amir Packaging, Rais Khan, has protested against creditors' plans to sell off the company's assets, according to reports.

Sources claimed that mounting debts of Dirham 80 million ($22 million) forced Khan to close the company's units in the UAE and flee to Pakistan earlier this year. Local reports said that Khan has broken his silence over the company's closure to protest against creditors' plans to recover their debts.

Khan said the company's assets are worth Dirham 150 million ($42 million) but the banks plan to sell them for Dirham 50 million. According to sources, Khan has asked the banks for some breathing space while he clears the outstanding debts.

|

CHINA

|

|

Sun Paper invets in LWC

Sun Paper of China has ordered a new 100,000 ton/yr lightweight coated (LWC) paper machine for its mill in Shandong province. The company is already busy installing the PM which was supplied by a local company. Startup is scheduled for May 2000.

The PM will mark the company's first foray into the LWC sector. Sun Paper has three machines with a total capacity of 150,000 tons/yr of packaging board and eight small machines which make 50,000 tons/yr of white paper.

|

JAPAN

|

|

Nippon and Daishowa plan merger

Nippon Paper Industries and Daishowa Paper Manufacturing have unveiled a merger plan that would create the largest paper producer in Japan on a consolidated sales basis. Nippon and Daishowa plan to integrate their operations under a holding company in April 2001.

Shareholders are due to vote on the proposed deal at the companies' annual general meetings at the end of June. Nippon and Daishowa must obtain a two-thirds majority in the shareholder vote for the deal to get the go-ahead.

|

ARGENTINA

|

|

San Andres starts up tissue PM

Papelera San Andres de Giles has started trial production on the new crescent former tissue PM at its mill outside Buenos Aires, in Argentina.

The company said that the 18,000 ton/yr Toschi machine is already producing paper that can be sold on the market. The company is fine-tuning PM 2 so that the machine can reach its maximum capacity.

Misionero wraps up rebuild

Papel Misionero has completed the $21 million upgrade at its Puerto Mineral site in Argentina. The rebuild aims to increase the PM's capacity of kraftliner and kraft paper from 65,000 tons/yr to 85,000 tons/yr. The move will allow the Argentinean producer to use all of its pulp internally.

Papel Misionero's resident manager, Luis Olmo, said that the machine's speed has risen from 400 m/min to 430 m/min since the restart. But Olmo said that the mill's ultimate goal is to ramp up the PM's speed to 600 m/min. The company expects the PM will reach the top of its startup curve by the end of the year.

|

BRAZIL

|

|

VCP makes move on Ripas

Votorantim Celulose e Papel (VCP) may be set to swallow up fellow Brazilian producer, Ripasa. The two companies are in talks on the move, which are due for completion by the end of May.

VCP has also unveiled plans to invest at its Luiz Antonio mill in Brazil. The company will spend $25 million on a third finishing line for the site to increase output of cut-size paper. VCP aims to convert 20,000 tons/month of paper at the mill by the end of the year.

AWA invests in Brazil

Arjo Wiggins Appleton (AWA) is spending $1 million upgrading the three PMs at its Industria de Papel de Salto mill in Brazil.

AWA bought out Votorantim Celulose e Papel's 51% share in the security and specialty paper mill at the end of last year. AWA is now the full owner of the mill in Sao Paulo state.

The chief executive officer of AWA's premium fine, specialty and coated division, François Wanecq, said the PMs are being fine-tuned to increase total output from 16,000 tons/yr to 24,000 tons/yr. Wanecq said that AWA is also looking at adding a fourth machine to the site in two years' time.

|

USA

|

|

Paperloop broadcasts to the world

Miller Freeman and Pegasus Capital Advisors are joining forces for the launch of a new online information and business exchange website, paperloop.com. The site aims to provide a complete range of personally customized transaction and information services, according to the company.

The new company will also provide links that will help users to develop cost-effective partnerships for conducting business across the entire industry spectrum. The service is geared toward manufacturers, converters, printers, suppliers and logistics suppliers, as well as the financial community and end-users.

|

Brazil

|

|

Orsa wraps up Jari takeover

The Orsa group has wrapped up a deal to take over Jari Celulose in Monte Dourado, Brazil. The new owner snapped up 96% of the voting shares in the heavily indebted pulp mill in the Pará state at the end of February. The unit produces 300,000 tons/yr of bleached hardwood pulp.

Orsa agreed to buy Jari from the Frering brothers through the Saga holding company at the end of 1999. Saga paid just $1 for the mill, but also agreed to take on Jari's debt, estimated at $340 million in 1997.

Saga's main shareholder, Sergio Antonio Garcia Amoroso, said that the company has had its eye on Jari since 1997. "The holding decided to invest in Jari as it saw the company had immense potential," Garcia Amoroso said.

Orsa had to negotiate with the pulp mill's creditors before it could take over the plant. The group of banks, led by the Brazilian Development Bank (BNDES), has agreed to a repayment plan drawn up by the new owner.

The eucalyptus pulp mill is also in dire need of investment. Jari needs modernizations totaling $54 million, according to a study carried out by Jaakko Pöyry for the pulp mill's previous owners.

Orsa has already begun an investment program to improve the plant's performance. A source at Jari said the focus of the project is to remove bottlenecks in the production process, as well as taking regular maintenance downtime. The modernization also aims is to improve the recovery boiler's efficiency.

|

Stock Watch International

Source: Morgan Stanley Capital Investment

|

| | | | | | | | | | | | |