|

BCTMP still has a big part to play in the world's papermaking capabilities, especially now that European influences are spreading

By Eric Cannell and Richard Cockram

The Future of BCTMP

Just over a decade ago, North America witnessed the heyday of market bleached chemi-thermomechanical pulp (BCTMP). Growth in the consumption of this particular grade was strong and Millar Western (Whitecourt), Fibreco, Temcell II, Cascades (Port Cartier), and Consolidated-Bathurst (Bathurst) had all recently started up. On top of that, four more mills were either under construction or in the design phase and BCTMP was selling for $630/air dried metric ton.

Worldwide, BCTMP capacity totaled 1.9 million tons/yr and was forecast to grow to 2.8 million tons/yr by the end of 1991. An additional 3.4 million tons/yr of capacity was also being considered for installation around the globe.

The popularity of BCTMP was to be found in several inherent advantages that it offered over other chemical pulps. For example, BCTMP offered:

- lower capital costs

- twice the yield (85% to 90% versus 42% to 52% for other chemical pulp grades)

- lower manufacturing costs

- higher bulk, opacity and stiffness

- reduced environmental impact.

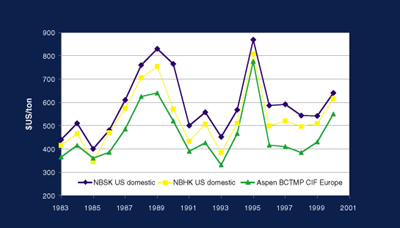

In 1992 though, the growth bubble burst. The selling price of BCTMP plunged to $330-400/ton as part of an overall collapse in the market pulp sector (Figure 1). Many BCTMP projects were cancelled outright, some capacity was integrated and several lines shut down. Contrary to the rosy forecasts, the magical growth of BCTMP came to a grinding halt. Except for a brief recovery in 1995, the selling price of BCTMP remained at these low levels, until recently that is.

Current capacity

It has been nine years since a greenfield BCTMP mill has started up and today the worldwide capacity of market BCTMP stands at 2.4 million tons/yr. Table 1 presents a listing of market BCTMP mills that are currently in operation, not including capacity that is integrated and not available for sale on the open market.

Figure 1: Average Annual Pulp Prices 1983-2000

| Note: BCTMP is defined here as high yield (ie greater than 85%) pulp produced by impregnating chips with a mild application of chemicals, refining the chips to produce pulp and bleaching the pulp to approximately 80% ISO for softwood grades and 85% ISO for hardwood grades. For the purposes of this article, alkaline peroxide pulp (APP) is considered to be market BCTMP. This is due to the fact that APP competes in the same market as BCTMP and has similar pulp quality. APP differs from BCTMP in that alkaline peroxide is used to impregnate the chips instead of sodium sulfite, and refining is done atmospherically instead of under pressure. |

Some 74% of the world's market BCTMP capacity is located in Canada. Low energy costs and proximity of wood species suitable for BCTMP production are the primary reasons. Another 20% of the BCTMP capacity is located in the Nordic countries, most of which dates from the early days of BCTMP (ie 1978-1985). As might be expected, BCTMP capacity in the Nordic countries has dropped since 1989 due to integration and shutdowns. Nordic capacity stands at 495,000 tons/yr compared with 505,000 tons/yr in 1989 - a 2% drop. On the other hand, Canadian capacity has increased from 1.04 million tons/yr to 1.80 million tons/yr, with most of this 70% increase having occurred in 1990 and 1991.

Contrary to earlier expectations, the production of market BCTMP has not taken hold in Latin America. In fact the 90,000 tons/yr of BCTMP capacity that existed in Mexico and Brazil in 1989 has been removed from the market. Several projects have been proposed, such as the Parana River project in Paraguay, but none have come to fruition. Tremendous potential still exists for the production of radiata pine and eucalytus BCTMP in Latin America.

See Related Table:,

Grades and end-uses

At present, 52% of BCTMP capacity is devoted to softwood grades, while 48% is focused on hardwood grades. This is a major shift from 1989 when softwood grades accounted for more than 90% of the installed capacity. The growth of hardwood BCTMP is primarily due to its successful application in printing and writing grades, especially in Europe and Asia. Hardwood BCTMP grades are currently made from aspen, birch and maple.

In 1989, the so-called 'woodfree rule' limited the amount of mechanical pulp that could be included in a 'free-sheet', or woodfree, grade to a 10% maximum. But between 1996 and 1998 this rule was, for all intents and purposes, eliminated in North America from all of the various paper standards.

The removal of this barrier helped boost the utilization of hardwood BCTMP. With the exception of 'permanent papers', buyers and sellers of free-sheet are at liberty to base paper purchase specifications solely on functionality. Nonetheless, some prejudice against mechanical pulps lingers. For permanent papers, ANSI/NISO and ISO standards limit the lignin content to 1%, thereby excluding the use of BCTMP. Research is ongoing in an attempt to have this limitation lifted.

| Table 2 - 1999 Consumption of Market BCTMP (million tons/yr) |

| |

Hardwood |

Softwood |

Total |

| Europe |

0.5 |

0.4 |

0.9 |

| North America |

0.1 |

0.3 |

0.4 |

| South America |

– |

0.1 |

0.1 |

| Japan |

0.1 |

– |

0.1 |

| China |

0.1 |

0.2 |

0.3 |

| Other Asia |

0.2 |

0.2 |

0.4 |

| World |

1.0 |

1.2 |

2.2 |

| Table 3 - Consumption of Market BCTMP in Europe (million tons/yr) |

| |

Hardwood |

Softwood |

Total |

| Woodfree papers |

0.4 |

– |

0.4 |

| Mechanical papers |

– |

0.2 |

0.2 |

| Tissues |

0.1 |

0.1 |

0.2 |

| Cartonboards |

– |

0.1 |

0.1 |

| Total |

0.5 |

0.4 |

0.9 |

Aspen is the predominant fiber source for hardwood BCTMP. While aspen BCTMP is typically produced at 200-250 mL Csf and 85% ISO, a range of brightness and freeness is available. Depending on the aspen grade, its tensile strength ranges from 80% to 100% of bleached hardwood kraft (BHK), while its bulk is always higher. This grade can be used by non-integrated mills to replace BHK in commodity coated woodfree grades at an application rate of 5% to 15% of the base sheet. The reported benefits include reduced manufacturing costs, improved formation, better opacity, increased bulk, greater sheet stiffness and lower porosity. Lower porosity improves coating holdout so that a higher filler load can be achieved without loss of bulk or sheet rigidity.

In uncoated free-sheet such as copy, forms and books, aspen BCTMP is typically applied in the 10-30% range, especially in non-integrated mills. Its use reduces manufacturing costs and improves bulk and formation. Aspen BCTMP is also used to replace a percentage of the chemical pulp in the outer plies of multi-ply packaging board.

| Table 4 - Consumption of Market BCTMP in North America (million tons/yr) |

| |

Hardwood |

Softwood |

Total |

| Woodfree papers |

0.1 |

– |

0.1 |

| Tissues |

– |

0.3 |

0.3 |

| Total |

0.1 |

0.3 |

0.4 |

| Table 5 - Consumption of Market BCTMP in Asia (million tons/yr) |

| |

Hardwood |

Softwood |

Total |

| Woodfree papers |

0.2 |

– |

0.2 |

| Mechanical papers |

– |

0.1 |

0.1 |

| Tissues |

0.1 |

– |

0.1 |

| Cartonboards |

0.1 |

0.2 |

0.3 |

| Newsprint |

– |

0.1 |

0.1 |

| Total |

0.4 |

0.4 |

0.8 |

| Table 6 - Hardwood Market Pulps - Comparison of Pulp Properties |

| Property Specie(s) |

Units |

BCTMP75% Maple 25% SW |

BCTMP Birch |

BCTMP Aspen |

BCTMP Aspen |

Kraft Mix HW |

Kraft Aspen |

| Brightness, ISO |

% |

78 |

85 |

85 |

85 |

90 |

90 |

| Freeness, CSF |

mL |

400 |

500 |

250 |

400 |

200 |

400 |

| Tensile Index |

Nm/g |

15 |

25 |

50.6 |

43.1 |

65 |

75 |

| Tear Index |

mN.m2/g |

3 |

4 |

5.5 |

5.5 |

8.0 |

9.0 |

| Burst Index |

kPa.m2/g |

1 |

1.5 |

2.9 |

– |

5.0 |

4.6 |

| Bulk |

cm3/g |

3 |

2.9 |

1.6 |

1.8 |

1.3 |

1.5 |

| Opacity |

% |

80 |

74 |

74 |

77 |

72 |

71 |

| Fiber Length |

mm |

0.7 |

1.1 |

0.77 |

0.87 |

0.70 |

1.0 |

Currently, Tembec is the only supplier of maple and birch BCTMP. Birch is also used in printing and writing grades, giving similar benefits to aspen. Birch has a higher bulk and a slightly lower tensile strength compared with aspen, making it the premier BCTMP grade for printing/writing grades. It is typically produced at 500 mL Csf and 85% ISO. Unfortunately it has limited availability.

Maple BCTMP is used in the center ply of multi-ply packaging board, replacing softwood chemical pulps. Benefits include reduced manufacturing costs, increased bulk, greater sheet stiffness and improved creasing and folding properties - less 'springback' for example. The higher bulk of maple compared with chemical pulps, translates into lower fiber requirements for the same basis weight. Maple BCTMP is produced at 400 mL Csf and 78% ISO. Part of Temcell's maple BCTMP production capacity is integrated with Temboard and is used in the production of multi-ply packaging board.

Softwood BCTMP is primarily used in tissue, toweling and fluff products, partially to replace bleached chemical pulp or secondary fiber. Birch and maple BCTMP are also used. Benefits include reduced manufacturing costs, greater absorbency and improved bulk. For tissue and toweling, the higher bulk of BCTMP permits a reduction in basis weight at constant caliper for significant reduction in fiber requirements.

The fluff market for BCTMP failed to grow as originally forecast due to the introduction of super absorbent chemicals. The use of such chemicals allows thinner diapers at equivalent absorbency, with a subsequent reduction of the fiber component in the product.

Softwood BCTMP is also used in copy, book, forms and the inner plies of multi-ply board. Softwood/hardwood blends are also available. These grades are used as a groundwood extender or to replace reinforcement pulps in lower brightness sheets to increase opacity or improve sheet formation.

On the market

Statistics for the production and consumption of BCTMP are kept a closely guarded secret by producers. This makes it extremely difficult to get accurate figures, even from trade associations. Based on the latest shipment figures published by the Canadian Pulp & Paper Association (CPPA), we believe current world consumption of market BCTMP is close to 2.2 million tons/yr, of which 52% is softwood and 48% hardwood. Europe remains the largest consuming region (Table 2), but Asia could soon overtake it.

To put this into context, world consumption of all bleached market pulps is around 40 million tons/yr, giving BCTMP a market share of a little over 5%. BCTMP consumption patterns vary considerably in different regions, for both historical and structural reasons.

Taking Europe first, BCTMP is used in a wide range of paper and board grades, but still only accounts for 7% of bleached market pulp consumption. Non-integrated woodfree paper producers have not seized the opportunity presented by aspen BCTMP to produce lower grammage grades with no loss of brightness, bulk, or opacity. They have been deterred by early 20th century definitions of woodfree papers, based on the quality of groundwood pulps at that time, and by exaggerated fears of yellowing. Metsä-Serla did take up the challenge with a new grade based on integrated aspen refiner pulp and aimed directly at traditional woodfree end uses, but its lead has not been followed.

Globalization helps change the BCTMP market

by Harold Cody |

| The use of BCTMP has undergone some big changes in just the last few years. In fact, it's practically a revolution since the early days when softwood grades predominated. The biggest change has been the emergence of hardwood as the dominant fiber resource. As usage has expanded via technical and market development efforts, producers are moving more and more tonnage into hardwood production. Examples include Tembec's shift of the former Donohue mill at Matane to more hardwood. Fibreco has also moved tonnage to hardwood.

In addition, markets have changed and expanded considerably. BCTMP is primarily an international product, with significant tonnage going into Asia. Notable changes also include wider acceptance in the US printing and writing market – long thought an area of great promise - but with little success until recently.

Growth in Asia

Demand growth in China has been key, but consumption in Korea, Japan and Indonesia has also expanded. Usage spans all grades, with growth in boxboard capacity providing probably the largest boost to demand. Six or seven major new boxboard machines have started up in Asia recently and considerable amounts of hardwood and softwood are used – in some cases up to 50% of the furnish. In Asia, considerable tonnage goes into mechanical papers, including newsprint and folding boxboard. But according to Dan Breck of Fibreco, little goes into absorbent grades. Breck adds that in Asia, BCTMP is the highest cost fiber in most grades. Mills use it to give bulk or opacity or both.

Ted Seraphim of West Fraser notes that the development of the market in China is certainly one of the most interesting trends, having gone from about 50,000 tons in 1995 to more than 300,000 tons currently. This means use has gone from 4% to 5% of a small market to about 10% of the three million tons of total market pulp China purchases annually, Seraphim observes.

Among the biggest changes in recent years has been growth in the use of BCTMP pulps in US printing/writing grades. Asian and European mills have used BCTMP as part of their furnish for some time, although use continues to be constrained in Europe by a "10% rule". Furthermore, papermakers are using it because of the benefits, not because it is cheaper. For example, inclusion can allow uncoated free-sheet mills to lower basis weight while meeting caliper targets because of the bulk provided by BCTMP.

Estimates of current use in printing and writing papers vary, but it has certainly increased. As Frank Graves of Tembec notes, the top papermakers in the USA in terms of size are using BCTMP in woodfree printing/writing papers and consumption has risen substantially in the last few years.

Usage in Asia has also expanded, with grades such as aspen sold as a direct replacement for hardwood kraft pulp. Levels vary from 10-20% in printing and writing grades. In coated grades, a lower bulk fiber may be used since calendering decreases bulk.

An important factor contributing to wider use in general in North America is the increased globalization of the pulp and paper industry. European mills now own more mills in North America. Since these companies often already use BCTMP at their European operations, they are now more interested in using it as part of their furnish at US mills, notes Greg Nielsen of Millar Western, the world's largest producer with 720,000 tons/yr of capacity.

Harold M Cody is executive editor of Pulp & Paper magazine in the USA

|

There are still some mills producing mechanical papers with market BCTMP, but the larger mills have invested in integrated BCTMP facilities or deinked pulp (DIP) plants. Tissue producers were keen to take advantage of the bulk and absorbency of BCTMP in the 1980s, but DIP is now the material of choice for most mills. BCTMP is highly effective in the middle layers of multi-ply cartonboards, but most of these products come from integrated machines in the Nordic countries with their own BCTMP lines.

In North America, most of the market BCTMP used in the USA and Canada is for tissue and towel grades. Both Scott Paper and Procter & Gamble were influential in developing grades of softwood BCTMP for absorbent products.

Small quantities of aspen BCTMP are used by non-integrated free-sheet producers, which historically have been constrained by a 10% limit on high yield pulps in free-sheet grades. The recent removal of this barrier will cause a steady increase in BCTMP utilization as the pulp supply tightens and free-sheet producers experience the benefits of BCTMP. Furthermore, when one considers that the production of white paper grades is forecast to grow significantly during the next few years, the demand for aspen BCTMP will become strong.

North American BCTMP producers will have difficulty meeting this increased domestic demand in the short term due to their current supply contracts to European and Asian customers. Assuming no new capacity is built, these producers are likely to shift more volume to domestic customers as their existing contracts expire to take advantage of the better mill net.

The North American paper industry is much more integrated with respect to pulp supply than the European industry, limiting the scope for market BCTMP suppliers. Competition with market DIP has also been a significant influence in the USA.

Looking to Asia, Japanese paper mills import substantial quantities of thermomechanical pulp (TMP) from Canada and New Zealand, but they are relatively modest users of BCTMP. The developing countries, however, increasingly need imported high yield pulps, due to their lack of softwood forests suitable for mechanical pulping.

The rapid expansion of the Indonesian pulp sector has limited the need for BCTMP in woodfree papers in Asia, but the new multi-ply cartonboard machines in China and elsewhere benefit from an inner layer of high yield pulp, which gives both bulk and stiffness to the product.

| BCTMP - examining wood species and pulp properties |

When considering fiber issues for BCTMP, a number of factors need to be taken into account. These include:

- long fiber length equals high tear, but low printability and poor formation

- hardwood fibers are shorter and have smaller diameters than softwood fibers

- short fibers equal good paper smoothness and opacity, but low tear strength

- small fiber diameter equals improved printability, opacity, and softness

vlarge fiber diameter equals high bulk, but reduced smoothness and printability

vthick fiber wall equals lower tensile, higher linting and reduced smoothness

- high wood density is more difficult to impregnate and can result in high energy requirements and chemical applications

vhigh extractives equal low brightness, high reversion, poor bonding and inferior absorbency.

Typical properties of commercial BCTMP pulps are compared with kraft pulp in Tables 6 and 7. The mechanical pulping process used to produce BCTMP affects the fibers in two important and fundamental ways. First, most of the lignin remains in the fiber. This causes the fibers to be relatively stiff and resistant to lumen collapse. In comparison, kraft pulp is essentially lignin-free and contains very flexible, collapsed fibers. The rigid tube-like structures of BCTMP fibers result in a higher bulk and generally lower bonding characteristics than chemical fibers. But the high lignin content negatively affects brightness stability. Prolonged exposure to sunlight causes the lignin molecules to become excited by ultraviolet rays, which in turn releases free radicals that oxidize to form yellow products. In this regard, hardwood BCTMP has an advantage to softwood BCTMP due to its lower lignin content.

The refining process generates a broad distribution of fiber sizes due to peeling and delamination along the length of the fibers and due to some fiber breakage. Fiber fragments, fiber fibrils and fibrillated fibers give BCTMP significantly more particle surface area per gram than chemical pulps. As a result, BCTMP exhibits superior light scattering compared with chemical pulp and consequently higher opacity.

The combination of short fibers (hardwood) with the size distribution generated by mechanical pulping also results in a significantly higher number of fibers per gram than chemical pulps or softwood BCTMP. This produces a sheet of finished paper that is smoother, less porous, more opaque, and with greater uniformity than woodfree papers made from chemical pulps. In addition, the bulk of hardwood BCTMP, while lower than softwood BCTMP, is still significantly higher than chemical pulps.

The properties of hardwood fibers are significantly modified by the strongly alkaline conditions found in the hydrogen peroxide bleaching stages of BCTMP. The fibers swell and lose some of their rigidity. The yield drops by several points. The bonding characteristics increase (ie tensile, burst, and to a lesser degree, tear), and the bulk and opacity decrease. By varying the alkaline application, BCTMP mills are able to offer customers the choice of high bulk or high tensile hardwood grades (aspen, birch) depending on the end-use requirements. In fact, high tensile aspen BCTMP has almost the same strength properties as aspen BHK at similar opacity. This capability is not possible with softwood BCTMP since softwood is only marginally affected by the alkaline conditions with peroxide bleaching.

Softwood and hardwood BCTMP have very different brightness development potentials. Fully bleached softwood BCTMP typically peaks at a brightness of 80% ISO, aspen at 86% ISO and birch at 88% ISO. The actual brightness of purchased BCTMP is generally one or two points below these peak values. For hardwood grades, as the brightness is increased from 80% to 87% ISO, there is a corresponding drop in bulk due to the requirement of additional caustic in the bleaching process.

End in sight

For certain end-uses, high bulk is more important that high brightness. In such cases, the hardwood BCTMP is deliberately bleached to lower brightness targets. For example, maple BCTMP destined for the center ply of multi-ply boxboard is typically bleached to 78-80% ISO. The lower brightness is not so important due to the fact that 85-89% ISO pulps are used in the top and bottom plies. Bulk and stiffness - parameters that are very important to the composite board - are improved by keeping the maple BCTMP on the low side. For a price premium, some BCTMP manufacturers offer aspen BCTMP that has been treated with optical brighteners. Brightness exceeds 90% ISO and the brightness stability is improved.

In view of the points outlined above, it is no mystery why hardwood BCTMP use has grown by a factor of 10 since 1989 and the growth of softwood BCTMP has stagnated.

|

Economic factors

Average mill manufacturing costs were calculated using NLK's proprietary software program - 'Compete in Pulp and Paper' - and are shown in Table 8. The costs at individual mills vary of course. On average, BCTMP manufacturing costs are $40/ton higher in the Nordic countries than they are in North America for aspen and $22/ton higher for softwood. This disadvantage is largely offset by lower average shipping costs for the Nordic producers.

North American producers have lower fiber and energy costs, but higher chemical and material costs than the Nordic producers. Higher shipping costs for North American mills reflect the fact that the majority of their production is shipped to Europe and Asia.

The selling price for aspen BCTMP has averaged $505/ton over the past 17 years, ranging from a low of $349/ton to a high of $781/ton. During this period, aspen BCTMP sold for an average of $67/ton less than BHK, or $128/ton less than BSK (the dollar values mentioned here have all been corrected to today's dollars based on the Producer Price Index). The capital cost for a 200,000 ton/yr BCTMP plant complete with zero liquid effluent is estimated at $200 million (± 30%).

| Table 7 - Softwood Market Pulps - Comparison of Pulp Properties |

| Property Specie(s) |

Units |

CTMP Spruce |

BCTMP Spruce |

BCTMP Spruce |

BCTMP Spruce |

Kraft Spruce |

Kraft Spruce |

| Brightness, ISO |

% |

60 |

79 |

78 |

78 |

89 |

89 |

| Freeness, CSF |

mL |

100 |

100 |

200 |

525 |

300 |

500 |

| Tensile Index |

Nm/g |

44 |

58 |

53 |

37 |

113 |

110 |

| Tear Index |

mN.m2/g |

7.0 |

6.5 |

8 |

11 |

8.1 |

9.2 |

| Burst Index |

kPa.m2/g |

2.7 |

3.8 |

3.2 |

1.9 |

9.0 |

8.2 |

| Bulk |

cm3/g |

2.5 |

1.9 |

2.3 |

3.0 |

1.4 |

1.4 |

| Opacity |

% |

95 |

84 |

80 |

81 |

65 |

65 |

| Fiber Length |

mm |

1.5 |

1.4 |

1.7 |

1.9 |

2.0 |

2.3 |

Technology update

Two of the eight Canadian BCTMP mills built between 1988 and 1991 were based on the APP process. The others were conventional BCTMP. That raises the question of whether one process is better than the other.

Initially, it was expected that the APP process could produce fully bleached market pulp without any bleaching stages after the refiners. As a result, it was claimed that the lack of post-bleach towers gave APP a capital cost advantage over BCTMP. In practice though, the final pulp brightness with this approach was lower than expected and the chemical costs were higher. APP mills consequently added post-bleaching stages.

Recently, Andritz has proposed using an inter-stage high consistency bleach tower instead. Pulp from the primary refiner would be sent directly to a tower where the residual peroxide could continue the bleaching reactions. Published laboratory results suggest that achievable brightness on hardwood grades would be just 80% ISO - well below the current grade specifications of 85% ISO. Furthermore, the latency has not yet been removed. Latent pulp stored at high consistency can develop 'permanent latency'.

For the moment, a greenfield APP market pulp mill would have to be built with a post-bleach stage (or stages), thereby eliminating its capital cost advantage. APP may have a specific energy consumption (SEC) advantage over BCTMP depending on the alkali/peroxide split between the impregnation stages and the post-bleach towers. As the split is shifted toward the front end, however, savings in SEC may be offset by increased chemical costs. Furthermore, a comparison of the APP and BCTMP commercial aspen pulp quality shows very little difference. We conclude that the differences between conventional BCTMP and APP becomes so small that the selection criteria becomes site specific.

There have been many significant technological advances made in the field of BCTMP production since 1989, many of which are summarized below. One trend here is in TMP refiner lines, which has seen a move to larger refiners and fewer refiner lines. For example, Papier Masson is in the process of installing a single line of refiners (CD-82) with a capacity of 740 tons/day to supply its newsprint machine. For a BCTMP mill that produces only a few grades, such an approach has merit.

However, many BCTMP mills today produce a myriad of grades. Wood species, freeness, brightness and bulk are all changed to generate different grades tailored to customer requirements. In some mills, grade changes take place every few days. A large, single line mill would result in very short run times and excessive amounts of transition pulp. With smaller independent lines, different grades can be produced on each line.

During the past five years, development in refining technology has focused on the reduction of SEC in the production of low freeness TMP for groundwood communication papers. With an SEC of 2,200-3,000 kWh/ton, the potential savings are large. Since the potential energy savings for BCTMP are generally lower, these technologies must be appraised on a case by case basis. In some cases, existing BCTMP mills can be retrofitted to these new technologies.

Closed loop control of the primary refiner consistency facilitates increasing the refining intensity by controlling the consistency to a lower set-point. The blow line consistency can be estimated by the process computer using mass and energy balances, or measured directly by a sensor installed in the blow line.

Refiner plates can be designed to give lower SEC values. The RT-RTS process designed by Andritz reduces SEC by virtue of the increased refining intensity afforded by operating the primary refiner at higher speeds. Pulp strength properties are maintained by pre-heating the chips to elevated temperatures for 10-18 seconds immediately prior to refining and again in a similar manner immediately prior to impregnation. The RT-RTS process has been installed at two mills and an additional four mills are equipped with its predecessor, the RTS process, which is still under evaluation. The RT-RTS process is not applicable to mills using APP.

The Thermopulp process pioneered by Valmet (formerly Sunds Defibrator) reduces energy consumption at the secondary refiner by heating the pulp at 160-165°C for 5-10 seconds between the first two refining stages. This process has been installed in seven newsprint mills, but it is still under development.

Low consistency refining (LCR) immediately after the high consistency refiner(s) can also be utilized. When retrofitted to an existing mill, increased production and energy savings are possible. At least one existing BCTMP mill has implemented this technology.

Increasing refiner throughput by debottlenecking upstream and downstream equipment is also useful.

| Table 8 - Typical BCTMP Manufacturing Costs |

| Location |

Hardwood1 $US/ton |

Softwood1 $US/ton |

Fiber |

Percent of Total Manufacturing Cost |

|

Shipping3 |

| |

|

|

|

Chemicals |

Energy |

Labour |

Material |

SG&A2 |

$/ton |

| North America |

250 |

268 |

25 |

18 |

22 |

13 |

12 |

10 |

62 |

| Nordic |

290 |

290 |

34 |

13 |

20 |

17 |

7 |

9 |

25 |

| Difference |

–40 |

–22 |

|

|

|

|

|

|

37 |

| Notes: 1. Excludes cost of delivery. 2. Sales, General & Administration. 3. Shipping cost is highly variable depending on BCTMP mill and clients location. Figures shown are based on the major markets being in Europe and Asia. |

In detail

Research has shown that high compression (ie 4:1) plug screw feeders (PSF) delaminate the chips, making them more amenable to impregnation. Although the energy requirements of these PSFs are high, the energy input to the refiners is somewhat lower.

The importance of a stable mass flow of chips to the refiners cannot be over-emphasized. We have observed MW load with a coefficient of variance of 10% over 2-5 second intervals. The disc gap swings in unison with the refiner load so that the pulp is over-refined one moment and under-refined the next. Average freeness targets are met, but the average pulp quality (shives, tear, tensile, burst, etc) is adversely affected. Fluctuations in chip feed rate can be due to erratic discharging of chip vessel (silos, bins, pre-heaters), poor level control, defective or worn metering screws, high backflow steam velocity, etc. Chip quality variations aggravate the situation, but are often not the prime cause.

The design of pulp screens has improved dramatically during the past five years. Shives in the finished pulp are virtually eliminated by using screens equipped with fine slotted (0.13-0.15 mm), wedge-wire baskets and sized to give low slot velocities. Low pulse rotors reduce energy requirements and contribute to the shive removal efficiency.

These screens also remove most of the dirt, forwarding it to the reject treatment system where the reject cleaners remove it from the process. In fact, the latest design for dirt removal prior to the pulp machine in market kraft pulp mills is based on fine slotted screens. With these points considered, are main line cleaners needed any more? This question must be evaluated on a case by case basis. Candidate mills should meet the following criteria:

- enforced bark content limits in the chip supply

- paved chip storage areas

- efficient sawdust removal at the chip screens

- effective chip wash with captured solids

purged from the mill

- modern screen room

- cleaners in the reject treatment system (preferably prior to the reject refiner).

The combined effect of eliminating main line cleaners and conversion to direct coupled screens with low energy rotors results in significant energy savings. Further energy savings are possible by installing a multi-stage screen such as that offered by Valmet. A single screen can replace three stages of screening. At the UPM-Kymmene mill in Rauma, Finland, eight pressure screens were replaced with a single multi-stage screen.

Several twin-line BCTMP mills were built between 1987 and 1992 that used screens to fractionate each line into two streams - one enriched with long fiber and one enriched with short fiber. Similar streams were recombined to produce a low fines pulp and a high fines pulp. It proved to be extremely difficult to balance the production rates on the two lines and still achieve the freeness targets of both products simultaneously. In addition, the two products were dependent on each other - one could not be produced without the other. If sales for product A were strong and sales for product B were weak, it presented an impossible situation and the concept was consequently abandoned.

Technology advances in thickening and mixing equipment allow bleaching at higher consistencies than ever before. In a modern bleach plant the consistency in the second bleach tower has increased to 35-40%. The consistency in the first bleach tower is 12% due to the recirculation of peroxide filtrate from the dewatering presses of the second bleach stage. Bleaching costs are lower due to more efficient bleaching at higher consistency.

Most BCTMP mills have added dedicated pulp washing presses following the final bleach plant dewatering press. This was required to satisfy customer complaints of high dissolved solids in the market pulp. This problem manifested itself in several different ways at the customer's paper machine through high COD losses, product odor and high costs for wet end chemicals. Initially, BCTMP mills were built with one dewatering press after the final bleach stage. This proved insufficient to remove residual chemicals and anionic trash left in the pulp from the bleaching process.

The ideal wash stage consists of a 30-60 minute hot water soak followed by thickening to a high consistency (40-50%). We know of one BCTMP that had such as system and it produced one of the cleanest pulps on the market. This design should be incorporated in all future BCTMP mills.

With an efficient wash stage following the bleach plant, the need for interstage washing is greatly diminished. In fact, the interstage wash stage has been removed in some BCTMP mills. In a typical installation, pulp is diluted after the primary refiner and pumped to screw presses. A portion of the filtrate is sent to effluent treatment, thereby purging resins from the system. Hardwood BCTMP mills experienced high suspended solids losses from this purge. Moreover the screw press baskets tended to plug progressively over time, causing reductions in production rate and eventually forcing the mill down to unplug the baskets.

In a new BCTMP mill, the capital used for an interstage wash would be better spent upgrading the dewatering stage prior to the unbleached high density storage to create a more effective hydraulic seal. Wood species that contain high levels of resins, such as southern pine, will still require an interstage wash to deal effectively with pitch deposits.

All but two of the BCTMP mills use flash dryers. One Nordic mill uses an airborne dryer and one mill in eastern Canada 'can dries' its product on a converted sulfite pulp cylinder dryer. Can dryers have higher operating costs and generally are used when there is a suitable idle paper machine available for conversion to a pulp dryer. This can reduce capital costs.

Flash dryers are designed to operate at much lower temperatures than those built in the early 1980s. This results in lower pulp brightness loss in the flash dryers and bales that are easier to repulp. Fuels that burn 'clean' must be used to fire flash dryers to avoid brightness loss due to soot contamination.

In contrast to BCTMP mills, airborne dryers dominate market kraft pulp. We expect to see a higher percentage of airborne dryers in future BCTMP installations as new mills seek to carve out a niche by offering an alternative to flash dried bales.

Yellowing of papers containing mechanical pulp has been a concern since the advent of market BCTMP. An extensive research effort spearheaded by the Mechanical Pulps Network has yielded impressive results. The mechanism by which BCTMP yellows has been determined and additives that inhibit this mechanism have been developed.

Paprican and Ciba Specialty Chemicals have developed a composite inhibitor that reduces the yellowing of BCTMP to near that of kraft pulp. Unfortunately the product must be applied on the surface of the paper sheet. This means that the total paper production must be treated and the BCTMP customer must apply the treatment rather than the pulp mill.

Obviously, this is not a concern for integrated mills. The inhibitor is available from Ciba but has yet to be used commercially. Ciba is searching for a suitable test site. The cost of the treatment may restrict its use to value-added papers. Notwithstanding these disadvantages, this is a significant breakthrough for BCTMP.

Commercially produced 'free-sheet' containing up to 20% hardwood BCTMP does not exhibit meaningful levels of brightness reversion even though laboratory results had suggested otherwise. The addition of 1-2% calcium carbonate to the furnish further stabilizes paper brightness.

The Outlook

Barring major economic disturbances triggered by events such as increasing oil prices and/or a stock exchange meltdown, the pulp sector faces a period of supply limitations and high prices. This is already triggering capacity investments by kraft pulp producers. But so far, nothing significant by BCTMP mills.

As pulp prices increase, the price differential between chemical and BCTMP grades tends to narrow (Figure 1) due to high demand for market pulp. But when prices cycle back down, as they inevitably will, some buyers will revert back to chemical pulps to avoid the inconvenience of using BCTMP. In an attempt to maintain market share, the selling price of BCTMP is lowered further, causing the price differential with chemical pulp to widen. Eventually, the selling price of BCTMP approaches its manufacturing cost and the profits of BCTMP mills evaporate.

For market BCTMP to increase its share of the market pulp sector in the medium to long term, it has to be more cost-effective in all periods of the price cycle. Customers must be given a compelling reason not to revert back to conventional furnish mixes each time the market cycles down. Investors must be convinced that profits can be maintained in all cycles before they will fund the installation of new BCTMP capacity. Below are a few concrete steps that existing BCTMP mills can take toward this objective:

- reduce SEC by one or more of the following - increase production rate, utilize low energy refiner plates, implement closed loop control of primary refiner consistency, install low consistency third stage refining

- improve impregnation with high compression plug screw feeders

- improve refiner stability

- upgrade the screen room to fine slotted wedge wire baskets (0.13-0.15 mm) for shive and mini-shive reduction

- in conjunction with the screen room upgrade, consider shutting down the main line cleaners (for energy savings)

- add a high consistency bleach tower

- add final pulp washing stage(s).

The next major step in grade development will be the introduction of eucalyptus BCTMP. In 1989, we forecast that this development was imminent. Unfortunately, the difficult financial times that engulfed market pulp producers in subsequent years put this development on pause. Now that profitability is returning though, we expect that the "pause' button will be released. We eagerly await the arrival of eucalyptus BCTMP because we forecast that the pulp quality will be greeted enthusiastically in the market place.

Eric Cannell is process specialist, NLK Consultants Inc, Montreal, Quebec, Canada. Richard Cockram is director of the London office of NLK Consultants Inc, and specializes in market research in pulp and paper

|