|

Pulp capacity expansions wil be thin on the ground in the near future. But this does not necessarily mean that producers will be having an easy time of it

By Rhiannon James

Market pulp come join the pulp party

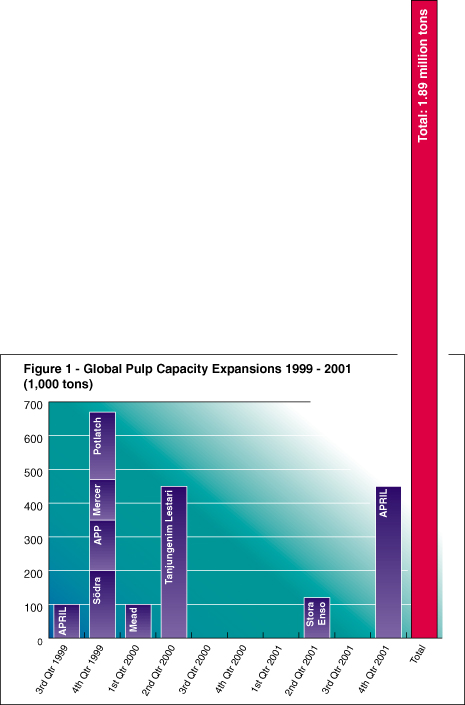

Preparing an article on expansion plans in the pulp and paper industry is usually a long and drawn-out process. Calculating net capacity increases and startup dates and double-checking the information on grades, machines and grammages is often time-consuming and can be a source of frustration. So, it came as rather a pleasant surprise to find that pulp producers have very little up their sleeves in the way of pulp expansions for 1999-2001. A quick glance at the tiny list in Figure 1 clearly shows that the next two years will be rather lean in terms of pulp capacity increases.

Apart from making this article a whole lot easier to prepare, the list is also good news for the pulp and paper sector. Anybody who has been following the industry in the last six months will know that pulp prices are shooting up at a rapid rate and producers are beginning to rake in healthy margins for a change.

In part, this is due to the tight global supply and demand situation that pulp producers are enjoying at present. The main reasons behind this favorable capacity situation are the closures connected to the introduction of the Cluster Rules in the USA, a series of global financial crises in recent years and increasing pressure from shareholders on pulp producers.

| Figure 1 - Global Pulp Capacity Expansions 1999 - 2001 |

| Company |

Mill |

Country |

Capacity Increase* (1,000 tons)

|

Grade |

Startup Date |

| EUROPE |

| Södra |

Mönsteras |

Sweden |

200 |

BSK |

4th Qtr 1999 |

| Mercer |

Rosenthal |

Germany |

120 |

NBSK |

End 1999 |

| Stora Enso** |

Imatra |

Finland |

120 |

HK/SK |

2nd Qtr 2001 |

| NORTH AMERICA |

| Mead*** |

Rumford |

USA |

100 |

HK |

Early 2000 |

| Potlatch |

Cloquet |

USA |

200 |

NBHK |

End 1999 |

| ASIA |

| APP |

Perawang |

Indonesia |

150 |

BHK |

4th Qtr 1999 |

| APRIL |

Kerinci |

Indonesia |

100 |

BHK |

3rd Qtr 1999 |

| APRIL |

Kerinci |

Indonesia |

450 |

BHK |

Late 2001 |

| Tanjungenim |

|

|

|

|

|

| Lestari |

Musi |

Indonesia |

450 |

BHK |

Early 2000 |

|

*Only confirmed projects over 100,000 tons net capacity increase have been included.

** The extra capacity at Imatra will be used at the plant's paper facilities, but Stora Enso will no longer need to purchase pulp from its Enocell plant. This will result in around 120,000 tons being released to the market.

*** The extra market pulp capacity at Mead is the result of the closure of four paper machines at the mill.

|

Reasons to be cheerful

The Cluster Rules have already prompted the closure of a whole host of mills in the USA over the last few years. In most cases, older mills were forced to shut down as the investments needed to make them environmentally friendly would have been unprofitable. As Ulf Gunnarsson, information director at Södra, puts it, "An obvious problem for producers has been the environmental issues in North America. This has led to a situation where it costs a lot of money to run the mills, especially if new equipment has to be installed."

The Cluster Rules in the USA have not only led to capacity being mothballed though, they have also boosted demand for market pulp. According to Robert Richards, director of fiber resources at Mead, "This is the first time we have seen the impact of closures on capacity. Whether the paper mills are integrated or not, they need fiber. Closed pulp mills, such as Kimberly-Clark's Mobile mill and Sappi's Westbrook mill are now buying in pulp and sucking up some of the excess capacity."

On top of the closures, another factor that has helped swing the supply/demand balance in favor of the producers is the number of investment projects that have been scaled back or canceled over the last few years. Financial crises around the globe have played a major part in the decisions of many companies to shelve expansion plans.

In Indonesia and Brazil for example, many projects were scrapped or put on the back burner when economic turmoil hit Asia and Latin America. Ironically, it is the pickup across Asian economies that has lead to the recent revival in the pulp market's fortunes. As demand bounces back in Asia, local producers need pulp supplies to feed their new and existing PMs. This leaves international pulp suppliers in a fortunate position as many of the region's own pulp investment plans have failed to materialize.

Increasing pressure from shareholders has also forced market pulp producers to put the brake on capacity expansions and this has led to a tighter supply situation in the market. Significantly, there is not a single greenfield market pulp mill due to start up in the world between now and the end of 2001. This is quite an astounding fact when you take into account the number of new mills that have popped up in Brazil and Asia over the last decade. But it is hardly surprising though when shareholders are breathing down the necks of pulp companies and the total bill for a greenfield mill can reach up to $1 billion.

Keeping a cool head

With a lack of major capacity projects on the cards for 1999-2001, some industry observers are starting to get edgy over possible pulp shortages after 2001. But producers do not seem to be overly concerned about a major deficit in pulp supplies. As the chairman and CEO of Mercer, Jimmy Lee, explains, "There is clearly a problem at this point based on the supply and demand situation and maybe there will be a shortage after 2001. But idle capacity can be brought on easily and capacity can increase through debottlenecking with relatively small investments. There will not be an acute shortage of pulp."

Richard Cockram of NLK Consultants shares this opinion. "Demand should grow by 3% this year and a similar amount in 2001, giving rise to deficits of around one million tons in 2000 and another two million tons in 2001," he explains. "These gaps will be filled by debottlenecking (capacity creep) and possibly restarting of some idle US pulp mills. We should have tight markets in both years."

Mark Kennedy at TD Securities also points to the importance of creep capacity. He warns, "We will see very surprising performances from the creep factor in market pulp capacity."

Kennedy believes that an extra 1.4 million tons of market and integrated capacity will hit the markets this year, with 1.2 million tons waiting to come into play for 2001. In theory, producers may also be tempted to restart some of the US mills that have been idled for market-related reasons, but the general consensus is that the Cluster-driven closures are likely to be permanent.

Figure 1 - Global Pulp Capacity Expansions 1999 - 2001

Alarm bells

All this good news does not mean to say that producers can sit back and relax though. Even if the list of confirmed projects for the next two years is a bit on the thin side, the low capacity diet is not guaranteed to last that long. As Gunnarsson of Södra explains, "Historically we know that when there is an increase in prices and the outlook is good, capacity plans do come along."

The danger of extra capacity projects is already looming in Latin America, where the leading companies have enormous pulp expansion plans in their top drawers. Aracruz, VCP, CVRD, Arauco, CMPC and Veracel are all planning major projects that could start up in the next five years.

For example, Aracruz has completed a feasibility study for the proposed 700,000 ton/yr eucalyptus pulp line project at its mill in Brazil. The company expected to make a final decision on the expansion at the end of the first quarter. Startup is likely to take place 18 months after the company's board gives a green light to the project.

VCP is also firming up details on a proposed new eucalyptus pulp line for the group's Jacarei mill. The company's board will make its final decision on the project by the end of the second quarter of this year. Since VCP first toyed with the idea of expanding the Jacarei mill, the forecast capacity has doubled from 200,000 tons/yr to 400,000 tons/yr.

Although none of these plans has received the go-ahead from the relevant management teams, the industry would be unwise to dismiss them as pie in the sky ideas. As Richards at Mead puts it, "In Brazil the costs are so low that there is no doubt that there will be more capacity there."

Further forward, there is also the threat of three new pulp mills coming on stream in the Baltics, a German plant and any number of Asian projects that could quickly get off the drawing board.

Demanding work

Some of this extra pulp will, of course, be needed in the years to come. Kennedy at TD Securities reckons that pulp demand is going to rise by 2.5 million tons in the next two years. Looking at the current supply/demand scenario, this will help to keep markets tight in the short term.

Some of this extra demand will be generated by the new paper projects popping up in Asia, especially in China. These companies will need to bolster their fiber supplies in the next few years as they start up big new paper machines. According to Norman Waite at Salomon Smith Barney, APP is one company that will find itself in this position. "As APP starts up over one million tons of woodfree capacity in China, this will require all the company's internal pulp and more, turning APP into a market pulp consumer rather than a seller," he claims.

Obviously, rising demand is not the only reason that companies will be adding extra capacity. There is nothing like the lure of rising pulp prices to get capacity expansion plans flowing. Lee at Mercer explains the mentality of pulp producers at the moment. "We have seen a fundamental change in attitudes in the pulp market, but it may not last if prices go over $800/ton," he says. "There is a strong level of discipline now, but not if there are further rises." Lee also adds, "The pulp market is a feast or famine situation. The last few years have been tough so it is normal that producers want to recoup some of their losses."

As always, there is the danger that producers could move too far, too fast. If producers raise prices too quickly, this could give way to vast capacity expansions followed by sudden price slumps. Cockram at NLK warns producers against taking this course of action. "The short term outlook is certainly good for pulp producers, provided they do not get too carried away with price increases," he says. "If they focus on debottlenecking and cost reduction projects in the next two years, rather than major capacity expansions, they should enjoy a 1986-1989-type recovery rather than the 1994-1995 disaster."

This time round though, industry observers believe that pulp producers have learnt the lessons of boom-bust cycles. Many analysts claim that companies are now becoming more responsible to their shareholders and are increasingly aware of the dangers of flooding markets with too much capacity.

Not everyone would agree with this positive picture though - even among the pulp producers. According to Richards at Mead, "I hear it every cycle that this time the producers have learnt their lesson. I have been working in this industry for over 30 years and we have never learnt our lesson. The problem is that banks are still willing to fund major capacity projects."

Enjoy it while it lasts

The message seems to be that pulp producers should enjoy the party while it lasts - or at least, for the next two years while the markets remain tight. After that, the capacity picture becomes rather cloudy, or even potentially stormy.

Even so, producers must be aware of the potential dangers that await them, especially if the US economy slows down as is widely predicted. There are already signs that inflation could rear its ugly head once again and oil prices recently hit $30/barrel.

As Cockram of NLK Consultants explains, "We think that a failure of demand is more likely to end this cycle than too much capacity. The US economy has been so strong for so long that a growth pause should be expected any time after this year. This could be triggered by a collapse of high

tech stocks, leading to reduced personal consumption, or by further interest rate increases."

Clearly then, there are a number of issues that could potentially put the market out of balance and see company profits slipping back into the red. But far be it from PPI to spoil the party.

|