| |

|

All mills today face considerable challenges in a global competitive environment where low cost and high quality are keys to success. Mills that either are not the largest or lowest cost are at a disadvantage, particularly in commodity markets increasingly dominated by large, modern, low-cost mills.

St. Laurent Paperboard Inc.—recently acquired by Smurfit-Stone Container Corp. (SSCC)—has completed a series of projects that positions its linerboard mill in La Tuque, Que., to compete globally. Seizing on opportunities presented by rapidly growing markets for high graphics corrugated paperboard packaging, the mill’s output over a number of years has been shifted to value-added grades.

Initially, tonnage on the largest machine at the mill was changed from commodity containerboard to white top linerboard. This past summer, a rebuild added the capability to produce coated linerboard, a grade new to North America. The machine will produce both uncoated white top liner and the new coated liner.

The path to becoming a cost competitive, modern board mill has been multi-faceted and broad. Since St. Laurent acquired the facility in 1994, investments throughout the mill have been made to upgrade and improve what was a higher cost containerboard and bleached board mill. By shifting more and more production to white top, and more recently to coated grades, La Tuque has become a premier mill.

For example, based on 1998 estimates by Jacobs-Sirrine, the mill is North America’s lowest cost white top linerboard mill, with a delivered cost of about $350/ton. This positions it well against other, often larger mills producing white top including International Paper at Mansfield, La., Smurfit-Stone at Brewton, Ala., and Green Bay Packaging at Morrilton, Ark. The La Tuque mill serves a broad base of clients located in the U.S., Canada, and select international markets.

The work at La Tuque was part of a grand plan that has been in the works since the mid-1990s. The core strategy has been to focus St. Laurent on higher growth, higher margin niche markets, including high quality graphics corrugated boxes and displays. To capitalize on these markets, the company has been increasing production of white top grades. But coated liner provides an even higher end product and offers customers a wide range of choices.

The improvements done at the Smurfit-Stone La Tuque mill, including the No. 3 machine modernization, were part of an overall plan begun by St. Laurent to focus on higher growth packaging markets.

CONSUMER PRODUCTS DRIVER. St. Laurent’s moves into white top liner and finally into coated grades has been driven by the strong growth in paperboard markets that demand excellent image quality. These markets include key products such as point-of-purchase displays, which was one of the key driving forces behind the initial growth in white top liner.

In addition, the strong growth in warehouse stores, where products are often packaged in larger sizes and where the package has to sell the consumer, has led to increased demand for high quality corrugated containers. These outlets want boxes that vividly display their contents. Sally Eddowes, marketing communications manager for SSCC, points out that market research has shown that consumers perceive products sold in white packaging to be of higher quality. Thus, packaging can be a key in marketing and selling any product.

The No. 3 machine at La Tuque is a huge multi-fourdrinier machine that was restarted in January 2000 after a revamp that included a new soft calendar and related coating equipment.

In turn, these end-use factors are expected by various market analysts to drive demand for white top grades up at about 3% to 4%/yr. Projections for growth in coated liner demand varies depending on the source, but range from a growth rate of 5%/yr up to 10%/yr.

The key market for coated liner initially is post-print applications, where the combined board is printed, according to Mike Butler, vp sales-graphics and specialty grades for Smurfit-Stone. These include displays and other packaging that often use multiple colors to generate eye-catching graphics. Another possible target for the company’s coated grade is as a replacement for heavy weight folding boxboard used in micro-flute corrugated packaging. This would entail use of a lightweight corrugating medium with the lightly coated liner on top.

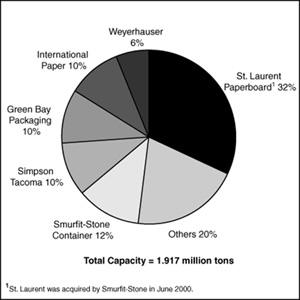

The overall white top market in the U.S. is almost 2 million tpy annually, with SSCC now the top producer (Figure 1). The high end coated liner market in the U.S. is dominated by imported tonnage, with Metsa-Serla/Kemi’s board from Scandinavia the largest single product. Various estimates put Kemi’s share of the U.S. market at 80,000 to 100,000 mtpy.

The Kemi coated liner grade is about a 200 gsm paperboard with an 81 brightness and about 9.5 to 10 gsm of coating. The new La Tuque coated liner is targeting about the same brightness, but due to its use of large amounts of sawdust furnish, the board is a more open sheet than Kemi’s product. The more open nature of the La Tuque sheet is expected to be an advantage for converters, since they should be able to run their corrugators faster. The mill’s coated board gloss target is 30 to 35. White top grades have a 14 gloss. There are other methods for producing coated linerboard, mainly by coating on the corrugator, but such a process is typically more expensive.

In terms of market and grade development, there were some technical issues that the La Tuque mill had to address as it developed its new product. A primary one was that if a heavy weight coating is applied to the sheet, such as 20 gsm, it closes up the sheet. When printed, this causes the sheet to not receive the ink well. The La Tuque mill and St. Laurent’s R&D staff worked diligently to develop a light coating so that the desired coverage and sheet properties could be achieved without excessively closing the sheet.

Overall, use of “white” boxes has been growing rapidly, initially via use of mottled white liner grades. Recently, however, the higher quality white top liner grades have been used more frequently in place of the mottled grades that were the first substrates. Thus, a coated grade is part of a natural progression in quality. The use of coated liner grades is a relatively new development, with most of the growth occurring in the last 2-3 years, Butler notes.

To support use of the new substrate, the company has created teams composed of expertise in printing, converting, and papermaking to offer customers the technical support needed to use the product. The company is also creating multiple distribution centers to meet customer demand and ensure inventory.

The acquisition of St. Laurent by SSCC will offer customers a “one stop shopping” advantage since they will be able to choose from a wide array of substrates and converting capabilities and locations. Grades available range from white top to bleached liner and now to coated liner (Table 1). The range of products available is a key capability available to customers, according to Jimmy Mackey, SSCC’s director of marketing. In conjunction with the teams being constructed to support use of the new coated grade, the broad product range now provides SSCC unmatched assets in graphics paperboard packaging and converting.

FIGURE 1. North American white linerboard producers (1999).

A CHANGE FOR NO. 3. In 1995, the No. 3 board machine underwent a major revamp. The project converted the wet end to a double ply, double fourdrinier. At the time, the top fourdrinier was the longest in the world at the time, required due to the slow draining nature of sawdust fiber used as furnish. The rebuilt machine was entirely new except for some dryer cans that were reused.

The rebuild led to a big change in product mix. In 1994 for example, white top accounted for 54% of the No. 3 machine’s production. But by 1997 it accounted for essentially all of the machine’s output. In addition, output rose to an average of 959 tpd in 1999 from a level of about 600 tpd in 1995. Output would have been even higher except for the limitation of pulp supply.

While the rebuilt machine produced an excellent sheet, the longer term plan called for improved output and efficiency, as well as introduction of coated linerboard. A recent strategic capital plan for the mill designed to accomplish these goals had four essential components, including sawdust screening and handling, a caustic plant upgrade, a new high density storage tank, and a coating conversion

UNIQUE SAWDUST FURNISH. Seventy percent of the mill’s furnish consists of sawdust, provided by sawmills and wood products operations in the area. Many of these are not owned by St. Laurent but operate on land managed by the company, which has contracts for all of the sawdust production off this land. All of the sawdust is softwood, consisting of about 80% jack pine and the remainder black spruce. Sawdust provides unique advantages owing to the fact that it tends to have an average fiber length that’s between softwood and hardwood, according to Stephane Rousseau, vp-operations at La Tuque.

While sawdust fiber provides key advantages, it also presents some process problems. The material includes unwanted by-products, such as scrap. In addition, material-handling costs were high, and frozen chunks of sawdust plagued the pulp mill. To address these, a new belt handling system replaced an older pneumatic system, providing considerable energy savings. A new screening system removes frozen clumps, large lumps, and other materials that plugged the digester and were difficult to handle. Screens remove metals and rocks.

The $14.4 million project created considerable savings the first year and annually thereafter, mainly via energy savings. In addition, the screening system has had a huge effect on improving pulp quality.

CAUSTIC PLANT. Other problems existed in the pulp mill, including a cooking liquor shortage that limited production. When the mill ran only 40% sawdust, liquor capacity was adequate. However, a switch to 70% sawdust for the furnish in 1995 meant more caustic was needed since pulping sawdust requires more chemicals.

A rebuild project, scheduled for completion in second quarter 2001 will increase capacity to 1,430 tpd. About 70% of the existing equipment will be eliminated, and the project will lower operating and maintenance costs. The $13.8 million project is expected to earn a quick payback. In the future, new technologies may be considered to improve pulping as well, including a switch to polysulfide pulping or use of anthraquinone.

INCREASED HD STORAGE. One efficiency problem the mill faced was a lack of pulp storage. The mill was running a 1,300-tpd paperboard mill but only had 400 tons of storage capacity. If something went wrong on the paper machine, it wasn’t long before the pulp mill was shut down. In addition, on lightweight grades the machine is speed limited so the pulp mill had to be slowed to match pulp and board output.

The storage problem is being addressed via addition of a new tank under construction and set for completion at the end of this year. With this addition, if the pulp mill is shutdown or if a paper machine goes down the two processes can be separated to avoid causing a disruption. This will also optimize maintenance at the mill by shifting all maintenance to one area or another. The pulp storage project cost $6.9 million.

Other work at the mill done before the recent capital investment program involved further fiberline modifications. The mill has produced all elemental chlorine free pulp since July 1999, when it moved to 100% substitution of chlorine dioxide for chlorine. Previously the mill had run at 75% substitution. A peroxide and oxygen bleaching system are used. Adsorbable organic halogen (AOX) levels have been reduced 70% since last summer and are already at or below the new regulated AOX limits that will be in place in Quebec in December 2000.

| roduct/Version |

Basis weight(lb) |

Brightness |

Smoothness |

Producing Mill |

| Coated White Liner |

| C1S Light |

31,33,41 |

80 |

N.A. |

La Turque |

| Bleached Liner |

| High Hold Out |

33, 37.5, 42 |

82 |

75 |

La Turque |

| Medium Hold Out |

33, 37.5, 42 |

82 |

100 |

La Turque |

| White Top Liner |

| Select |

31 |

76 |

210 |

La Turque |

| |

36 |

76 |

225 |

La Turque |

| |

23.5 |

72.5 |

200 |

La Turque |

| |

26 |

72.5 |

200 |

La Turque |

| |

29 |

72.5 |

200 |

La Turque |

| |

31 |

72.5 |

210 |

La Turque |

| Preferred |

33 |

72.5 |

225 |

La Turque |

| |

33 |

72.5 |

230 |

West Point |

| |

37.5 |

72.5 |

225 |

La Turque |

| |

38 |

72.5 |

255 |

West Point |

| |

42 |

72.5 |

265 |

La Turque |

| |

42 |

72.5 |

280 |

West Point |

| |

69 |

72.5 |

340 |

West Point |

| |

36 |

72.5 |

225 |

La Turque |

| High Performance |

36 |

72.5 |

250 |

West Point |

| |

56 |

72.5 |

320 |

West Point |

TABLE 1.St. Laurent graphic paperboard products from La Turque, Que., and West Point, VA mills (data are target values).

PM 3 REBUILD. The No. 3 machine is a huge multi-fourdrinier configuration more common to Europe than North America. The top fourdrinier is used to form the bleached ply, which is mated to the unbleached ply from the base fourdrinier. The machine has a Valmet Sym-Sizer, added in 1987 to apply starch at the size press, thus one key piece of equipment to make coated grades was already installed. The use of the Sym-Sizer to apply starch has meant that the market views St. Laurent’s white top grades as having among the best quality on the market. The wet end of the machine was converted to alkaline papermaking in early 1999.

Having a Sym-Sizer meant the mill already had the equipment necessary to apply a film coating. However, to produce coated grades, coating color handling equipment and piping to the Sym-Sizer were needed. A new GAW coating kitchen was installed to mix and process coating color.

| Growing the Smurfit-Stone box

|

| In May, at a special shareholders meeting, the merger of St. Laurent with Smurfit-Stone Container Corp. was approved by St. Laurent shareholders. This culminated a remarkable transition for St. Laurent since its inception in 1994.

Through a series of acquisitions, the company—led by CEO Jay Gurandiano—had grown to become a major North America producer and converter of high-quality, value-added paperboard products. From 1994 to 1999, the company grew from $160 million to almost $1 billion in net sales.

The company began with a base of two primary paperboard mills in La Tuque and Matane, Quebec, and five converting locations in Canada. Through the ensuing years, a wide array of converting operations was acquired, in addition to the startup of several state of the art micro-flute sheet plants. In 1997, St. Laurent purchased Chesapeake Corp.’s West Point, Va., mill.

By the end of 1999, 54% of St. Laurent’s primary capacity was dedicated to value-added grades. The recently completed project discussed in this story was one key facet of this strategy, in addition to the expansion of the converting side. The $25 million investment at the mill added the ability to produce up to 50,000 tpy of coated white top linerboard.

The West Point mill produces white-top liner, kraft liner, and medium. The company’s Matane mill produces both semi-chemical or recycled corrugating medium, and a mill at Thunder Bay, Ont., produces featherweight corrugating med-ium, where it is reported to be the only mill in North America able to produce such a grade, with basis weights ranging from 26-lb down to 14-lb. This capability ties in well with the company’s strong push into high value corrugated packaging, since featherweight medium is a key component of micro-flute packaging.

|

Also to accommodate coated production, infrared dryers were added following the coater and a Teflon coating was applied to the initial dryer cans following the Sym-Sizer. Additional scanners supplied by ABB Automation were put in place, and a video break detection system was installed to monitor the sheet.

A Kuster’s soft nip calender was installed as part of the coated conversion. A key reason for choosing it was its compact size, since it was being installed on an existing machine. Located before the Sym-Sizer, it is not used for caliper control, but rather for sheet density control. Sheet density influences coating penetration and thus coat weight and printability. The dry end already had a soft calender in addition to a steel roll machine calender. A number of dryer cans were removed to make room for the calender. A new chute was added to allow broke to be pulped in the basement.

The board coating is a combination of calcined clay and latex, with ground calcium carbonate added in the wet end (under alkaline conditions).

Part of the market strategy behind the project is that the mill wants to satisfy the widest range of printers, rather than just high end offset printers. In terms of corrugated markets, about 25% of printers are high end, but the remaining 75% are medium to low end producers. The pre-print market is also a target for the new grade. Low end converters might print two colors for example, while direct high end post printing may apply up to five colors. Thus the board has to be designed with all of these customers in mind.

The rebuilt machine—with the new soft calender and related coating equipment—started up in January 2000. The first coating trial was in mid-February. In June the mill ran its last trials on coated board, and product was sent to converting plants for test runs. Trials completed so far have been successful. Commercial tonnage was expected to be available by late fall.

The original strategy for the LaTuque mill, following its conversion to coated grades, had been to produce about 5,000 tpy of coated grades by year end 2000. However, it appears now that the goal will be higher, possibly near the 30,000 tpy level, although this is yet to be determined. The strategy on startup was to introduce lightly coated grades (completed in July 2000) and then to assess heavier coat weight products.

The No. 4 machine remains dedicated to bleached board grades, including a focus on cup stock, where it is reported to be one of the top quality producers. The sawdust furnish provides some advantages here as well. Production of milk carton stock has been phased out on the machine. In the long term, an obvious question is the future of this machine. It is possible that the machine might be converted to coated grades as well, and the addition of an off-machine coater has been discussed. However, no plans are firm at this time.

Other long-term issues for the mill include looking for ways to further reduce energy costs. One option that has been examined is installation of a co-generation plant. The mill is currently working on reducing non-condensable gases (NCGs)and will have a low volume, high concentration (LVHC) system in place this year and a high volume, low concentration (HVLC) system next year. All of the mill sludge is used for silviculture, with some composted and some directly land applied. One work in progress is an evaluation of the use of enzymes to reduce sludge odor.

Among the biggest investments made in the mill after the 1994 acquisition was addition of secondary effluent treatment in 1995 at a cost of C$45 million. This new system and other changes at the integrated kraft facility allow it to operate at extremely low effluent levels. Effluent quality have been improved steadily year upon year, and in 1999 reached levels of 0.94 kg/ton BOD and 0.48 kg/ton TSS. Following the switch to ECF, AOX has been cut by more than one half.

While the earlier goal was to produce about 5,000 tpy of coated linerboard at the La Tuque mill, the mill is reassessing that plan and might produces as much as 30,000 tpy this year.

|