| |

| FORECAST (000) |

| US (000 tons) |

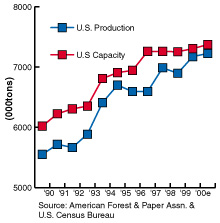

1998 |

1999 |

2000e |

| U.S. Production* |

6,896 |

7,173 |

7,225 |

| U.S. Capacity* |

7,253 |

7,305 |

7,372 |

| Utilization rate (%) |

95.1 |

98.2 |

98.0 |

| Imports 000 |

358 |

340 |

350 |

| short tons |

|

|

|

| Exports 000 |

1,122 |

1,125 |

1,142 |

| short tons |

|

|

|

| Apparent U.S. consumption |

|

|

|

| 000 short tons |

6,132 |

6,388 |

6,433 |

| lb/capita |

45.5 |

46.6 |

46.8 |

| 000 tons/billion $ |

0.71 |

0.72 |

0.69 |

| real GDP (1992) |

|

|

|

| *Note: Production and capacity of bleached packaging paperboard and bleached bristols. Source: American Forest & Paper Assn. and U.S. Census Bureau |

| TOP N. AMERICAN PRODUCERS |

|

| |

Annual

capacity*

(000 tons) |

Market

share

(%) |

| 1. International Paper |

2,875 |

39.4 |

| 2. Westvaco |

1,635 |

22.4 |

| 3. Potlatch |

625 |

8.6 |

| 4. Georgia-Pacific |

340 |

4.7 |

| 5. Smurfit-Stone |

320 |

4.4 |

| 6. Blue Ridge Paper |

270 |

3.7 |

| 7. Gulf States Paper |

265 |

3.6 |

| 8. Fort James |

225 |

3.1 |

| 9. Weyerhaeuser |

220 |

3.0 |

| 10. Durango-Georgia1 |

200 |

2.7 |

Total U.S. capacity (2000): 7,372,000

Capacity share of top five companies: 79.5%

Capacity share of top ten companies: 95.6%

* Capacity includes bleached packaging board and bleached bristols. 1. Formerly Gilman Paper Co.

|

|

Bleached paperboard: High operating rates at SBS mills support pricing

INDUSTRY STRUCTURE. Bleached paperboard, also known as solid bleached sulfate (SBS) board, is a premium paperboard grade that is produced from a furnish containing at least 80% virgin-bleached woodpulp. The major markets for SBS are folding cartons, milk and juice cartons, and disposable foodservice products such as paper cups, plates and food containers. Lightweight bleached board grades not primarily intended for packaging are classified as bleached bristols. Coated bristols are used for paperback book covers, greeting cards, postcards and advertising cards, among other products. Uncoated bristols are used for tickets, tags, file folders, etc. Most companies report the combined capacity and production of bleached paperboard and bristols.

For 2000, total bleached packaging paperboard capacity is approximately 5.8 million tons and bleached bristols account for an additional 1.5 million tons. In the packaging segment, folding cartonboard represents about 52% of the total; milk carton and foodservice products, 42%; linerboard, 3%; and other miscellaneous converting, 3%.

PRODUCTION/CAPACITY. Most of the consumer packaging markets served by bleached board are mature and growth has been very slow over the past few years. As a result, bleached paperboard production has averaged about 1.5% per annum over the past five years. At the same time, bleached board has lost market share to flexible packaging materials, plastic containers and 100% recycled and unbleached kraft paperboard.

Much of the recent growth in bleached board has come from exports. Exports, mostly folding carton and milk carton stock, have represented about 20% of industry production and have been growing faster than domestic shipments. U.S. producers are competitive with European producers and have gained strong market share in Europe, Latin America and Asia.

Industry capacity growth has slowed to 1% annually, limited to productivity gains at existing paper mills. No new bleached board machine has been built since 1995 and none are planned.

OUTLOOK/PRICING. The industry has become increasingly concentrated and specialized as individual companies have focused their growth plans on particular segments of the industry. Production capacity is fairly concentrated, with the top three producers accounting for approximately 70% of industry capacity.

The industry is undergoing significant restructuring, as a series of mergers and assets sales have consolidated market share for fewer producers. During 1999, Westvaco Corp. strengthened its position as the country’s second largest producer of bleached board with the purchase of the Eastex bleached board mill in Texas from Temple-Inland Inc., adding 670,000 tpy of production capacity.

Champion International Inc. sold its bleached paperboard mill in Canton, N.C., and its DairyPak packaging business to Blue Ridge Paper LLC, a private investor group which includes mill management and employees. In 1998, Gulf States Corp. and Georgia-Pacific Corp. agreed to combine the marketing and sales organizations of their bleached board mill operations in Alabama and Arkansas.

Bleached board mills face a competitive market. The competition is heated among bleached board, coated recycled board and coated unbleached kraft board for market share in the U.S. folding carton market. But cost pressures have increased for all grades of paperboard, due to higher prices for pulp and recovered fiber, energy and transportation. As a result, bleached board producers raised prices twice during 1999: $40/ton in June and $50/ton in September. A third price increase of $40/ton was pushed through in March of this year. As a result, the benchmark price of 16-pt SBS folding carton board increased to $860-$880/ton. This is the highest price level since 1995. Most producers announced another $40/ton price hike for August.

BY NOEL DeKING News Editor

|