Coated groundwood: acquisitions, rising prices, little new capacity drive sector

GRADE AND USAGE. Almost half of U.S. coated groundwood shipments are used in commercial printing (catalogs, direct mail, Sunday newspaper supplements, advertising inserts, and directories), followed by magazines. Coated groundwood (also known as wood-containing) papers contain 10% or more mechanical softwood pulp and are almost universally coated on both sides. They are typically lower brightness, less expensive and lighter weight than coated free-sheet. Primary classifications for coated groundwood papers are Nos. 4 and 5. No. 4 has both mechanical and chemical pulp, and a No. 5 has mostly mechanical pulp.

No. 5 papers account for less than half of the total U.S. coated paper produced. Coated groundwood papers are commonly made in the 32-lb to 50-lb range (25 x 38 inches), although basis weights can run as low as 24-lb and as high as 70-lb. The most popular category is LWC or lightweight coated (32-lb to 40-lb) which accounts for more than 80% of coated groundwood. Coating weight is approximately 30% of total sheet weight for LWC papers. Basis weights continue to decline in papermakers’ efforts to help publishers, direct marketers, and commercial printers save money on postage and other weight-related costs.

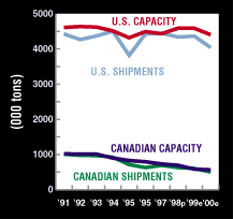

About half of total 1999 U.S. coated paper shipments were groundwood grades. Shipments of coated groundwood papers totaled 4.5 million tons, up 2.4% from 1998, according to the American Forest & Paper Assn. (AF&PA). Shipments to magazine publishers were up slightly (1.4%) in 1998, while shipments of No. 5s to commercial printers declined 16.5% in 1998.

CAPACITY. The top 10 producers control 90% of North American capacity. Champion International Corp. is set to become the largest producer of coated groundwood papers in North America following the February announcement that it would be acquired by UPM-Kymmene Corp. of Finland in a $6.5 billion deal.

The first place spot was formerly held by Consolidated Papers Inc., which also became an acquisition target this year when Stora Enso of Finland announced it would buy the company for $4.8 billion.

Total coated groundwood capacity is expected to remain flat through 2002, according to the latest capacity survey from the AF&PA. Almost all producers surveyed in 1999 reported unchanged capacities from 1999 through 2002, AF&PA said. By 2002, coated groundwood capacity will be about 4.6 million tons, roughly flat with decade-ago levels.

Canadian coated groundwood capacity is expected to rise 5.4% during the 1997-2000 period. In Europe, there are several machines proposed including Haindl Papier GmbH in Germany and Cartiere Burgo SpA in Italy.

MARKETS/OUTLOOK. Producers implemented two price increases on coated groundwood grades in 1999. Prices started out the year 8% to 10% below 1998 levels but gradually increased, with No. 4 50-lb groundwood hitting $890-$980/ton by year-end. The year-end prices for No. 4 and No. 5 34-lb roto rolls were up 3.9% and 1%, respectively.

During the first quarter of 2000, the price of No. 4 50-lb groundwood was stable at $890-$980/ton while No. 5 34-lb roto hovered at $1,000-$1,040/ton. A $60-$80/ton price increase on coated groundwood grades has been announced for Apr. 1 based on strong demand, the lack of new capacity coming online, recovery in the Asian markets, and escalating pulp prices.

Pulp & Paper Forecaster expects modest increases in coated groundwood demand in the U.S. in both 2000 and 2001, averaging less than 1% per year.

BY NICOLA MCINTOSH

News Editor